Airbnb economics: booking volume, fees, and a global network

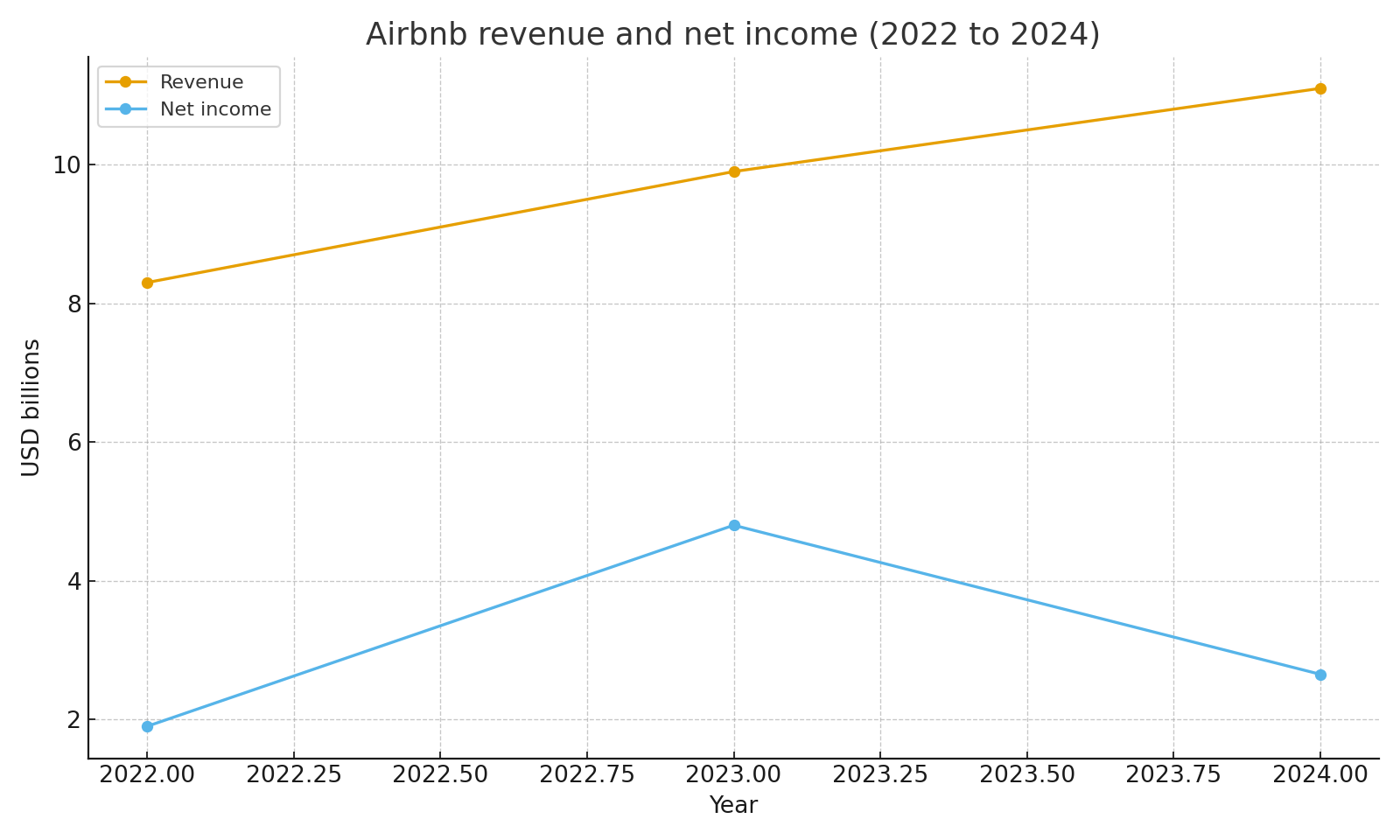

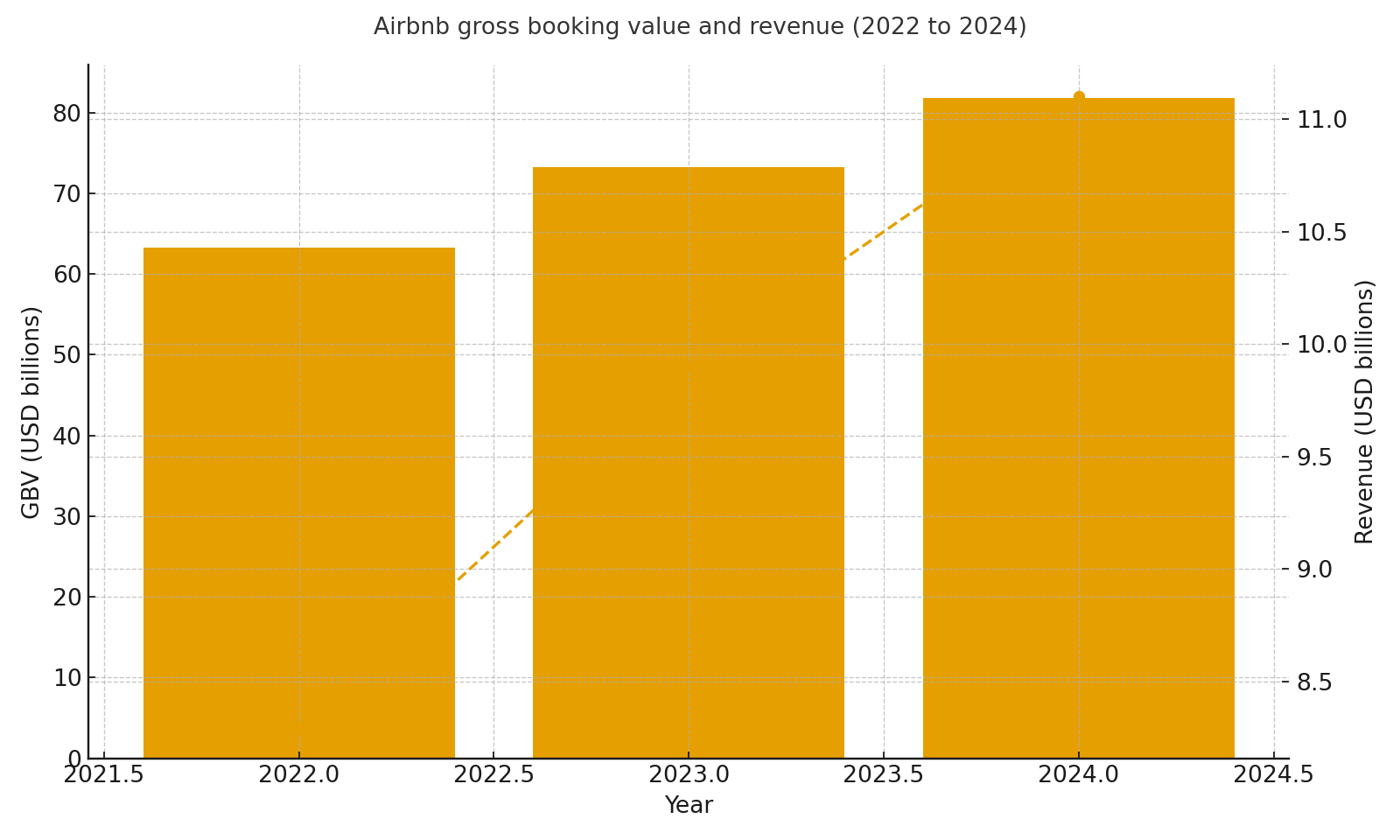

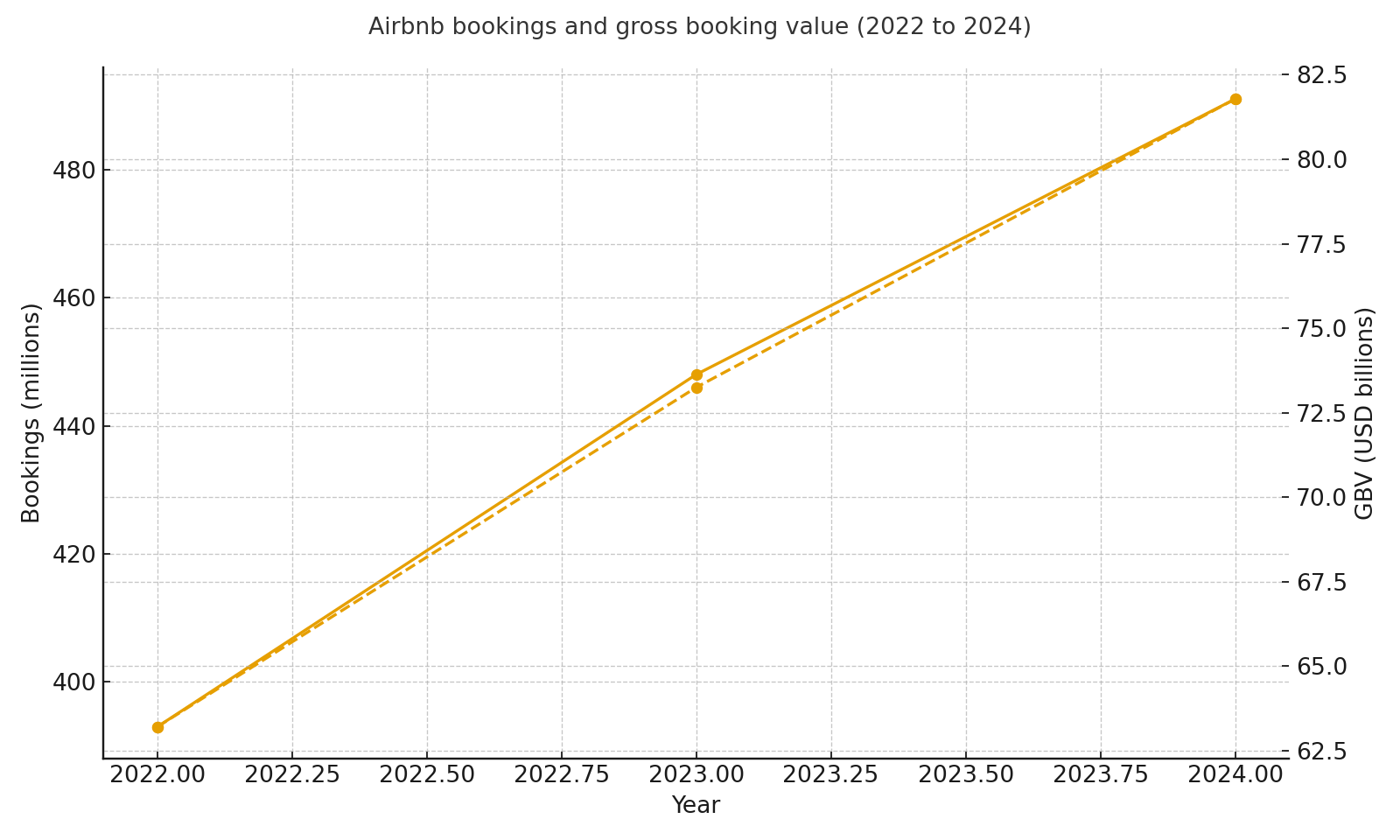

TL;DR: Airbnb runs a marketplace where guests pay hosts for stays and experiences, and the company takes a fee from both sides. From 2022 to 2024, revenue grew from about $8.3B to about $11.1B. Net income moved from about $1.9B to about $4.8B and then to about $2.6B as a large tax benefit in 2023 did not repeat in 2024. Gross Booking Value rose from a little over $63B in 2022 to nearly $82B in 2024, driven by more bookings and steady average booking values.

Revenue and profit from 2022 to 2024

Airbnb became profitable on a full year basis in 2022 and stayed profitable through 2024. Revenue increased each year as travel demand recovered and international trips grew. Net income expanded sharply in 2023 and then declined in 2024, mainly because 2023 included a large one time tax benefit and 2024 included related tax expense, not because the core business deteriorated.

Revenue and net income 2022 to 2024

Revenue and net income 2022 to 2024

Gross Booking Value and revenue

Gross Booking Value measures the total dollar value of bookings on the platform before Airbnb’s fees. It grew from about $63.2B in 2022 to about $73.3B in 2023 and about $81.8B in 2024. Revenue grew more slowly than GBV because Airbnb takes only a slice of each transaction, but the two lines still move together over time.

Gross booking value and revenue 2022 to 2024

Gross booking value and revenue 2022 to 2024

Bookings and spending per booking

Bookings rose from roughly 393 million in 2022 to about 448 million in 2023 and around 491 million in 2024 based on external estimates. At the same time, GBV per booking stayed healthy. That combination shows that Airbnb grew by both adding more stays and keeping average spend per stay solid.

Bookings and GBV 2022 to 2024

Bookings and GBV 2022 to 2024

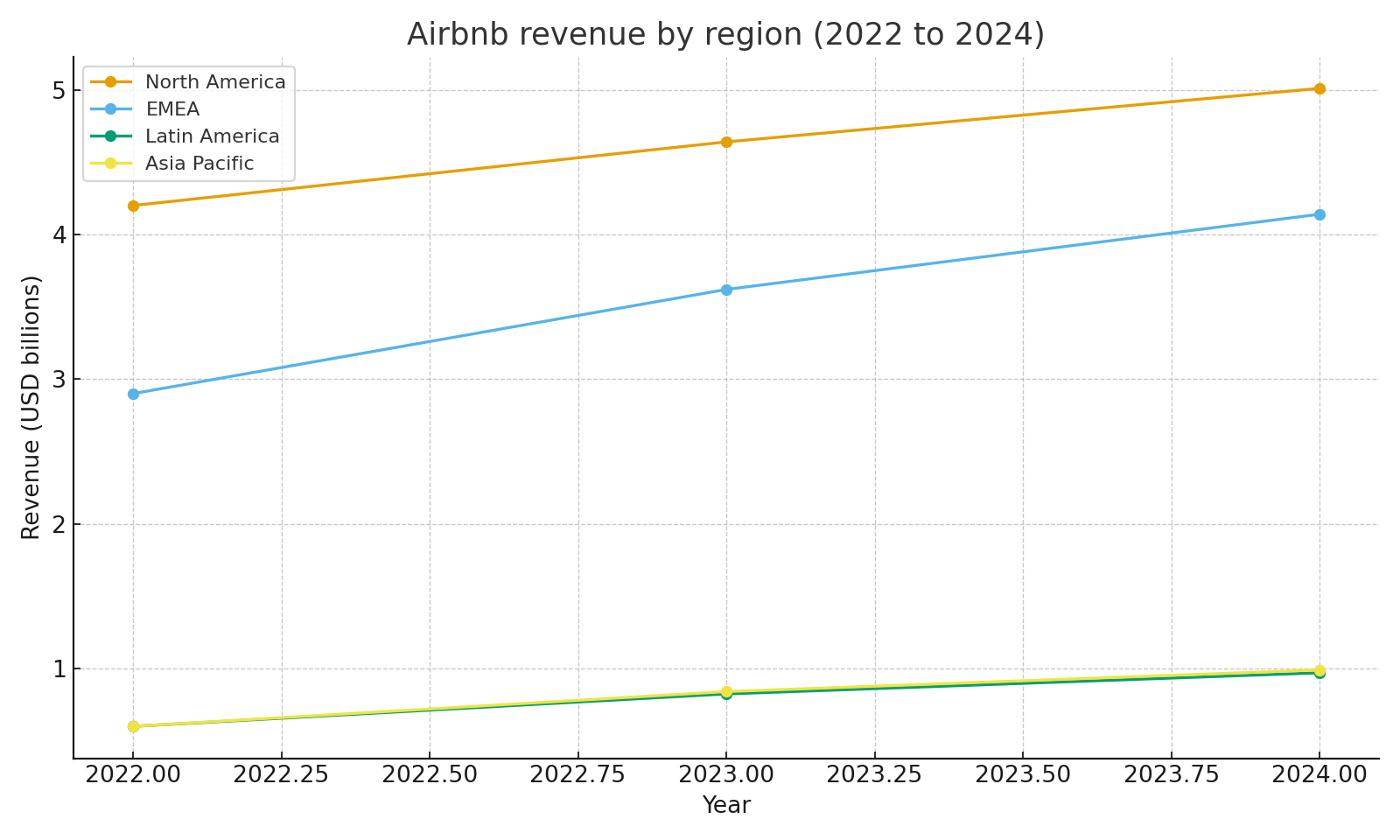

Where the revenue comes from

Airbnb groups its revenue into four regions. In 2022, North America contributed about $4.2B, EMEA about $2.9B, Latin America and Asia Pacific about $0.6B each. In 2023, North America grew to about $4.6B, EMEA to about $3.6B, and both Latin America and Asia Pacific to around $0.8B. By 2024, North America reached about $5.0B, EMEA about $4.1B, Latin America about $1.0B, and Asia Pacific just under $1.0B.

Revenue by region 2022 to 2024

Revenue by region 2022 to 2024

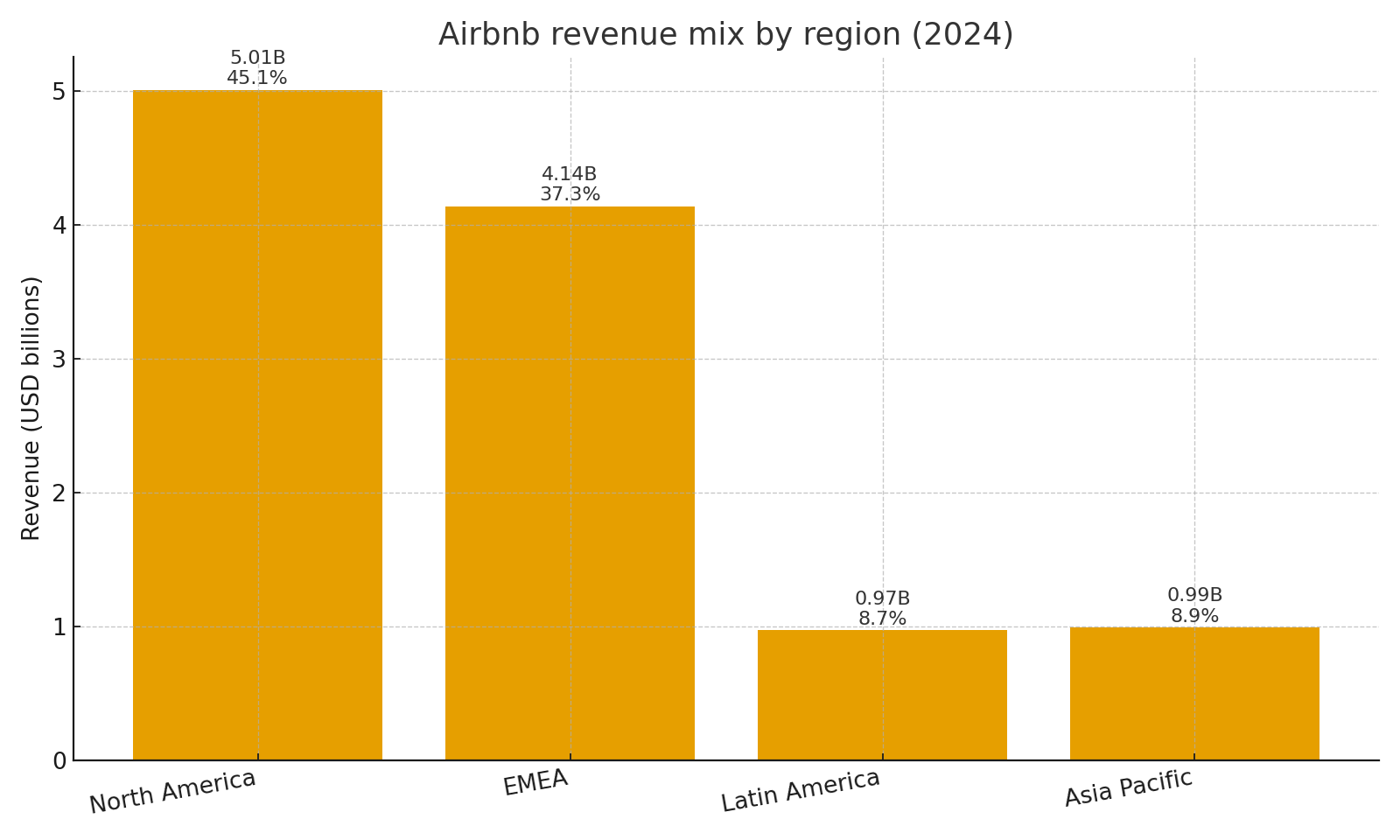

In 2024, North America represented about 45.1 percent of revenue, EMEA about 37.3 percent, Latin America about 8.7 percent, and Asia Pacific about 8.9 percent. This mix shows that Airbnb is still strongest in North America and Europe but is also building a meaningful presence in Latin America and Asia Pacific.

Revenue mix by region in 2024

Revenue mix by region in 2024

Why this model works

Airbnb does not own most of the properties on its platform. Instead, it connects hosts and guests and earns a fee on each booking. That asset light model means the company can scale globally without building hotels. As the number of listings grows and the app becomes more useful, more guests come to the platform, which attracts more hosts. That loop supports growth in bookings and Gross Booking Value.

Risks to keep in mind

Regulation is a major risk. Cities and countries can limit short term rentals, add taxes, or require stricter compliance from hosts and platforms. Housing concerns can lead to tighter rules in popular urban markets. Competition from hotels and other booking platforms can pressure fees and marketing costs. Currency swings affect reported results because so much revenue comes from outside the United States.

Sources

- Airbnb 2022, 2023, and 2024 shareholder letters and Form 10 K filings for revenue, net income, and Gross Booking Value

- Airbnb and third party statistics for regional revenue splits, bookings, and GBV by year