Amazon economics: stores, ads, and the cloud

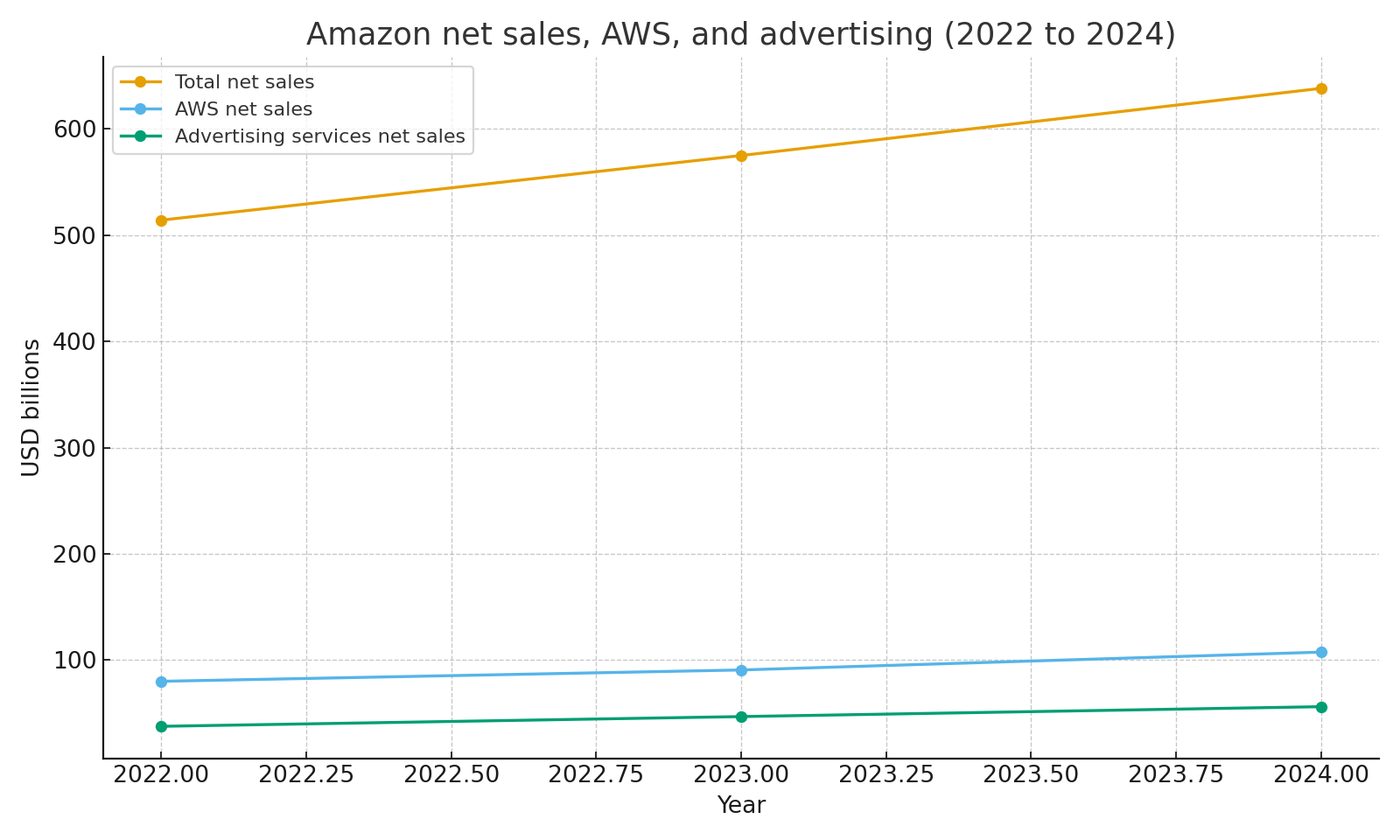

TL;DR: Amazon runs a huge retail and marketplace business on top of a high margin cloud and advertising engine. From 2022 to 2024, total net sales moved from about $514B to about $638B. AWS net sales increased from about $80.1B to about $107.6B, and advertising services grew from about $37.7B to about $56.2B. AWS produced a large share of operating income, while retail and ads drove scale.

How the revenue mix has evolved

Total net sales keep growing, but the role of services inside that total keeps getting bigger. AWS and advertising sit on top of the store and marketplace and earn higher margins than most retail sales.

Net sales with AWS and advertising 2022 to 2024

Net sales with AWS and advertising 2022 to 2024

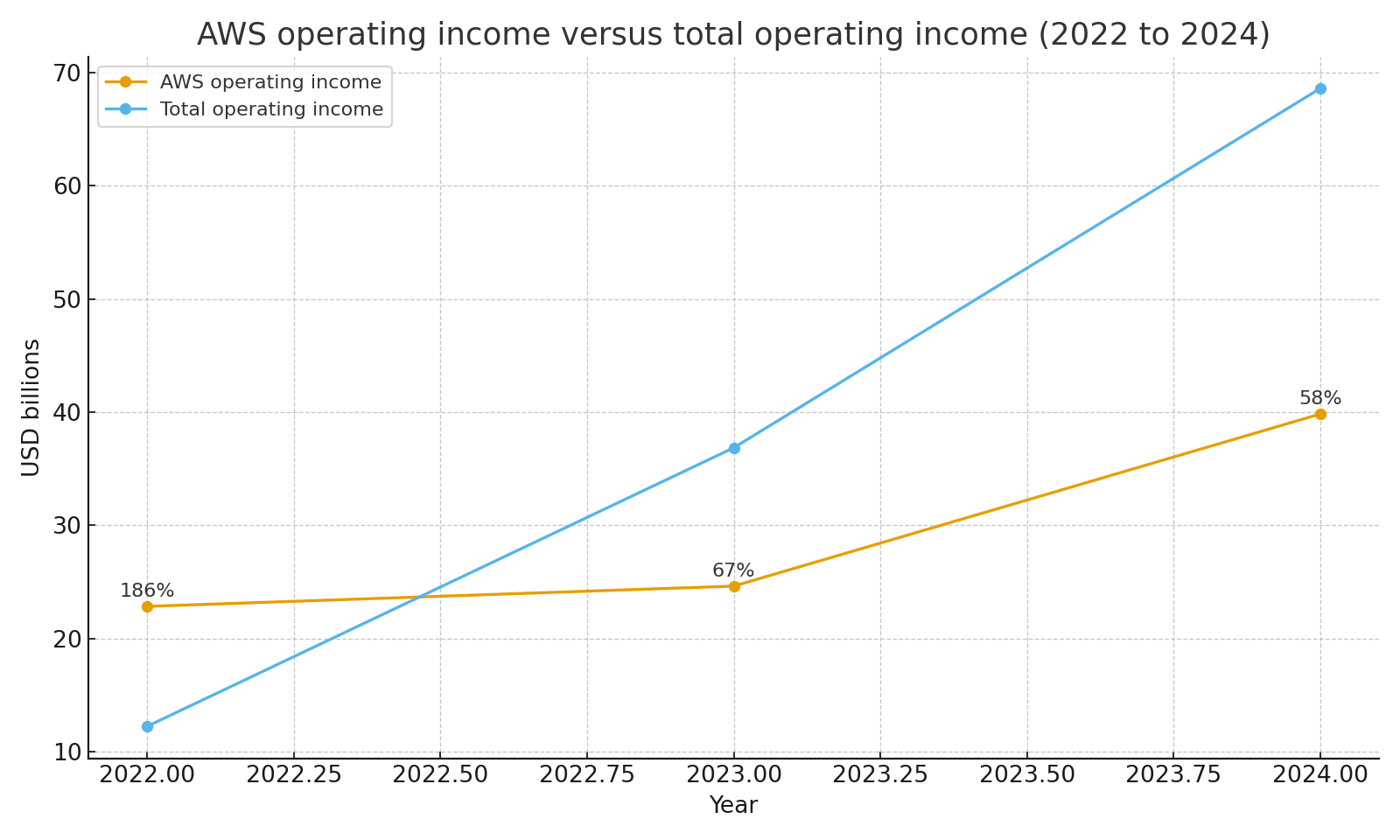

AWS as a profit engine

AWS operating income has exceeded total company operating income in some years, which means the cloud business offset losses in other parts of the company. In 2024, AWS operating income was about $39.8B compared with total operating income of about $68.6B, so AWS contributed close to 58 percent of operating income.

AWS operating income versus total operating income

AWS operating income versus total operating income

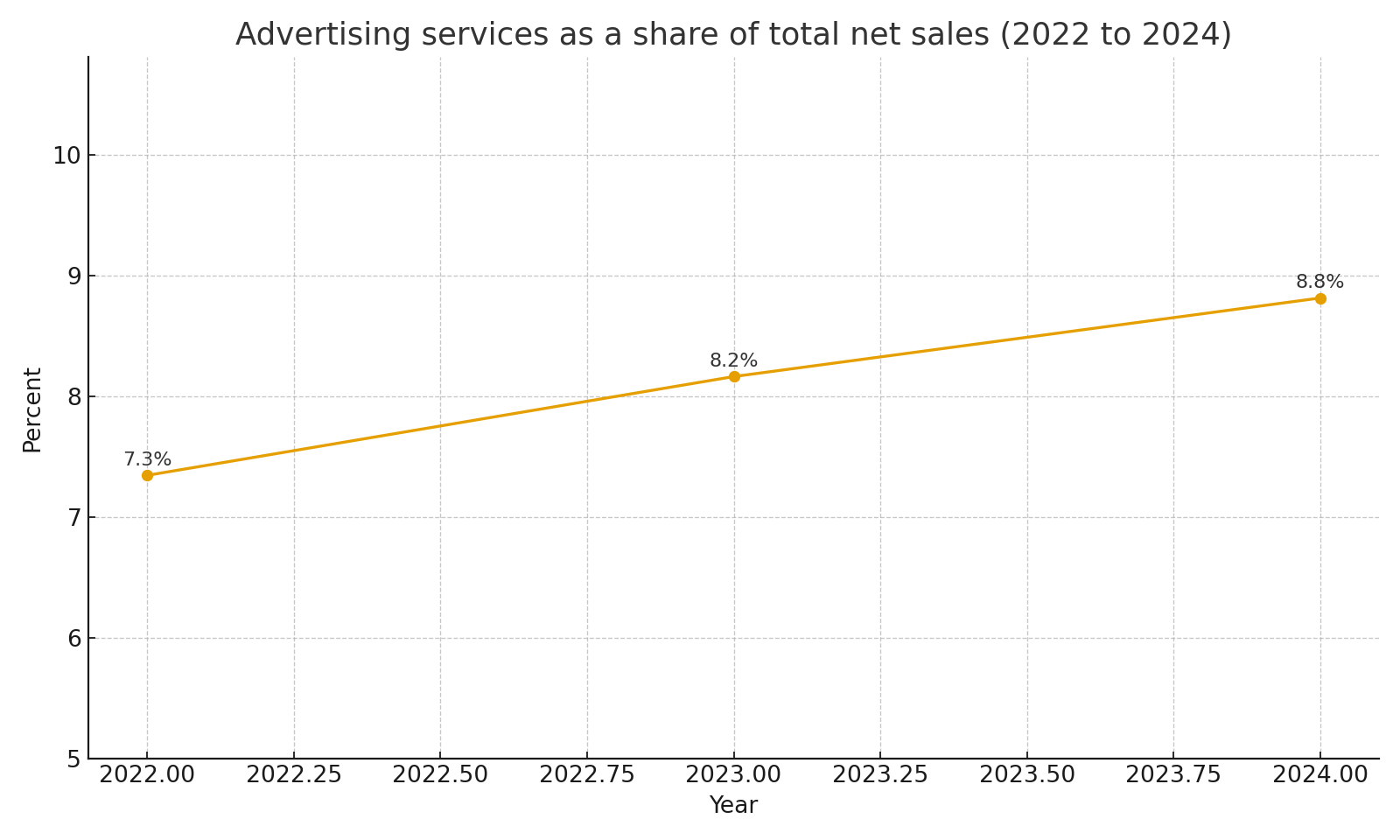

Advertising as a growing slice of revenue

Advertising services have grown from about $37.7B in 2022 to about $56.2B in 2024. As a share of total net sales, ads have climbed steadily. By 2024, ads represented roughly 8.8 percent of net sales. This is important because ads carry strong margins and build on traffic that the retail store already has.

Advertising services as a share of total net sales

Advertising services as a share of total net sales

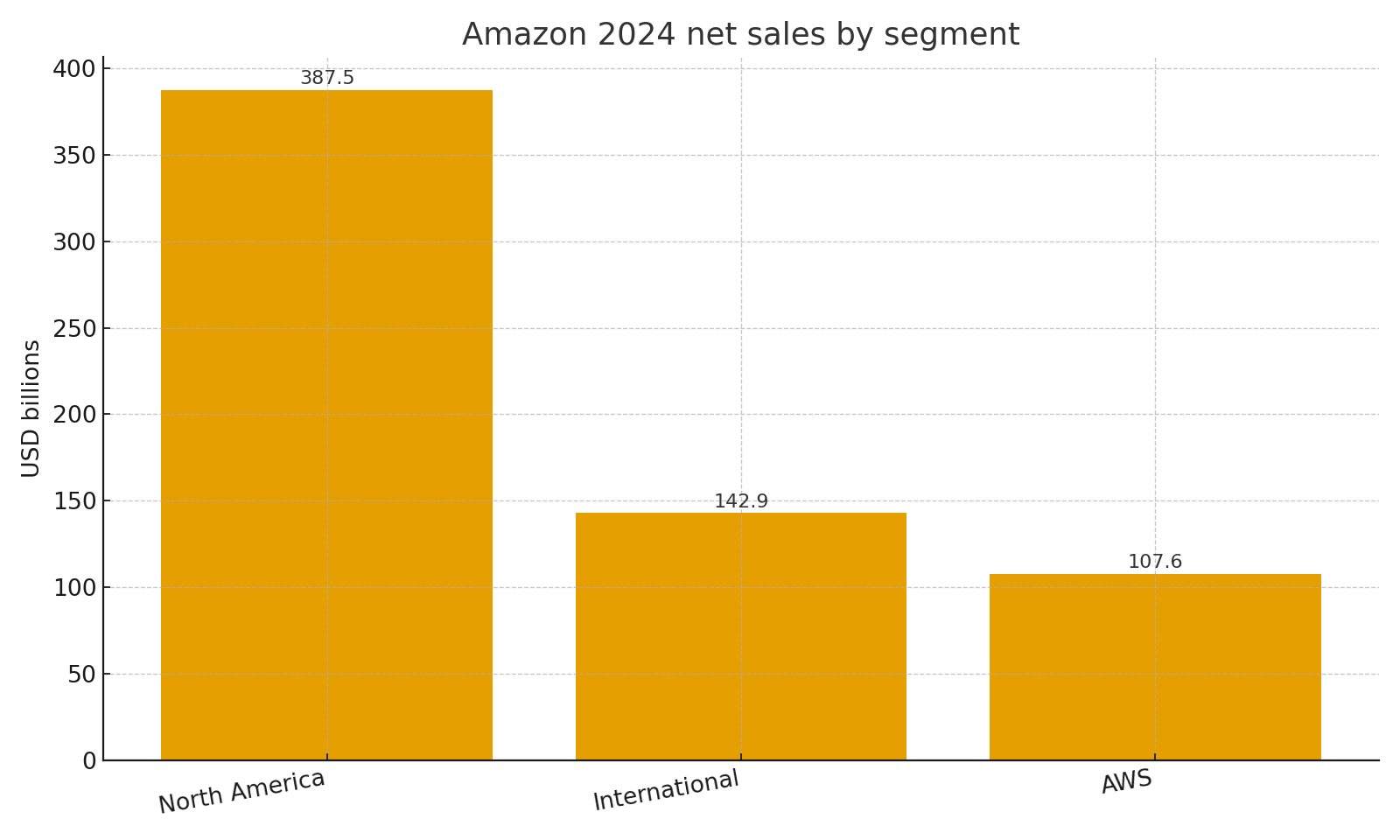

Segment scale in 2024

In 2024, North America net sales were about $387.5B, International net sales were about $142.9B, and AWS net sales were about $107.6B. The chart below shows that stores still dominate the top line, even though AWS and ads are large on their own.

Segment net sales in 2024

Segment net sales in 2024

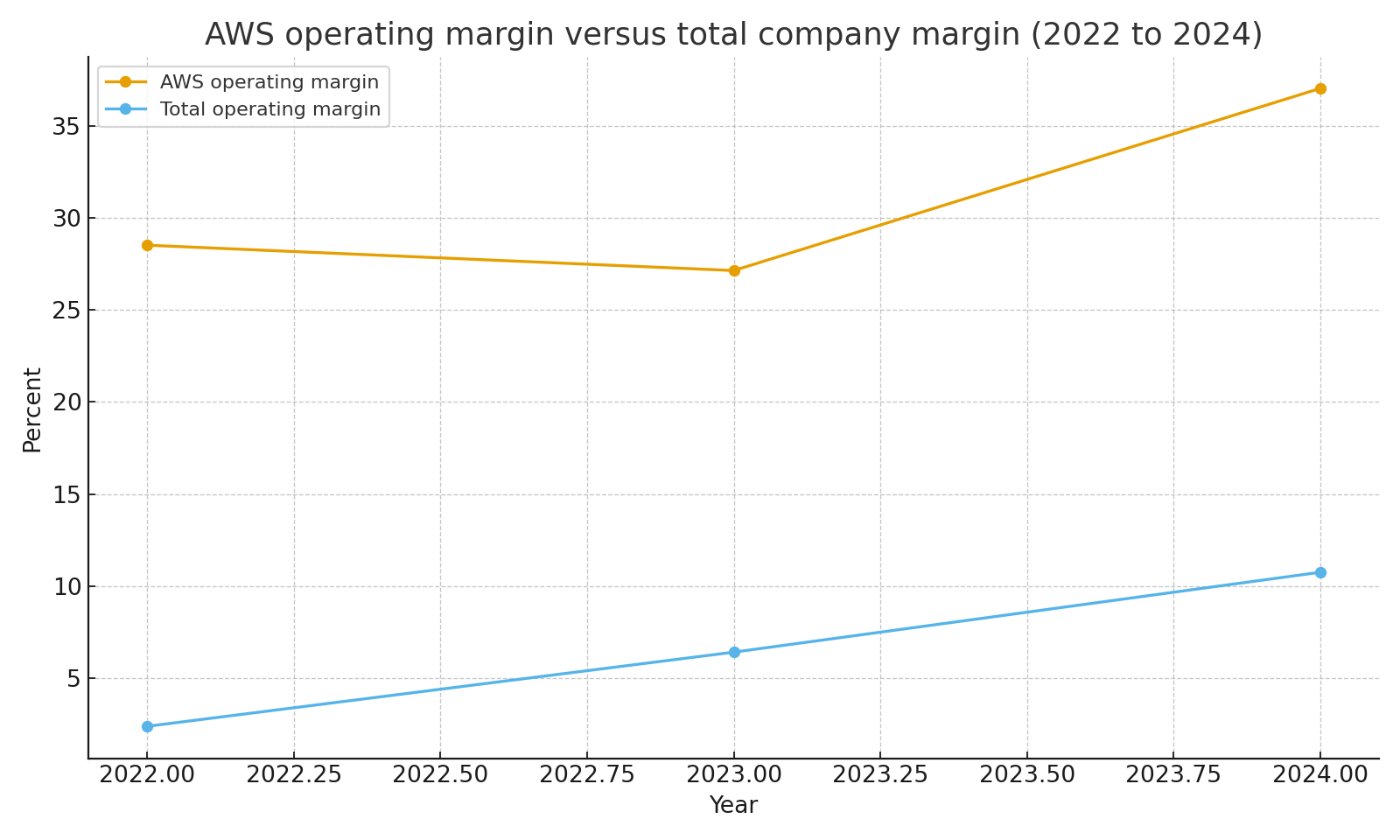

Margins for cloud versus the full company

AWS earns a much higher operating margin than the company as a whole. Across 2022 to 2024, AWS operating margin stayed in the mid to high twenty to mid thirty percent range, while the total company margin moved around the low to mid teens. In 2024, AWS operating margin was a little above 37.0 percent, versus a total company margin of around 10.8 percent.

AWS operating margin versus total company margin

AWS operating margin versus total company margin

Why this model works

The store gives Amazon volume. Third party sellers and advertising monetize that traffic. AWS adds a high margin engine that benefits from long term contracts and heavy cloud usage. Together, these layers support steady growth in revenue and a rising base of operating income, even when parts of the business face cost pressure.

Risks to watch

Retail is sensitive to consumer demand and shipping costs. Cloud and ads face strong competition from other large tech companies. Regulation can affect marketplace practices, data use, and ad targeting. Currency and macroeconomic changes can also move reported growth.

Sources

- Amazon 2024 Annual Report and Form 10 K for net sales, segment revenue, advertising services, AWS results, and operating income