Costco economics: the engine behind low prices (Option C upgrade)

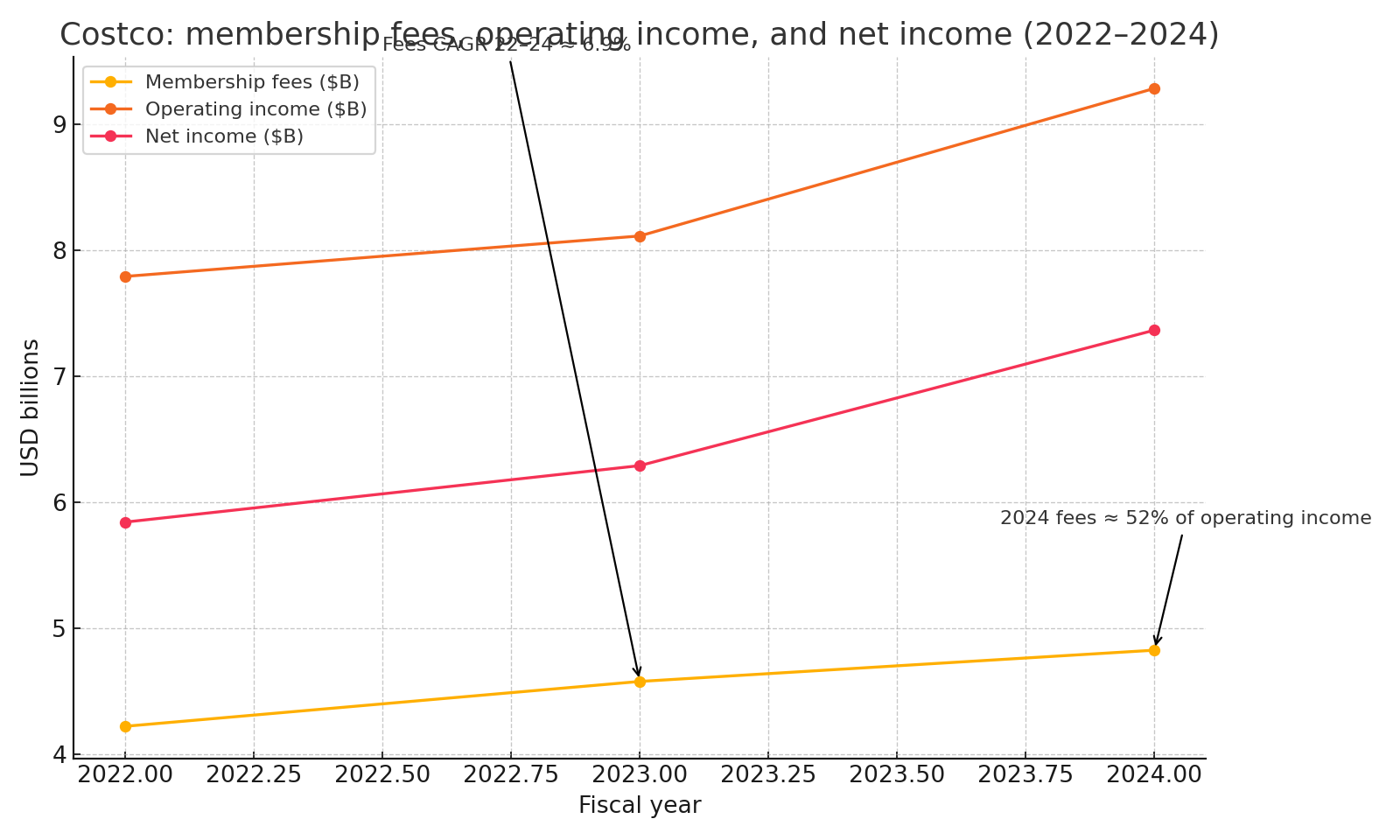

TL;DR: Costco’s profit model leans on memberships. From 2022 to 2024, membership fees grew from $4.224B to $4.828B, while operating income rose from $7.793B to $9.285B and net income reached $7.367B. Renewal rates stayed very high at 92.9 percent in the United States and Canada and 90.5 percent worldwide. Executive households were about 46 percent of paid members, yet generated 73.3 percent of worldwide sales. The result is durable profit at everyday low prices.

The core flywheel

Costco keeps margins tight to win trust. The company limits selection in each warehouse to about four thousand items, buys in scale, and moves product fast. That discipline shows up in margin and in the value members feel on every trip.

Membership fees, operating income, and net income

Membership fees, operating income, and net income

Why memberships matter to profit

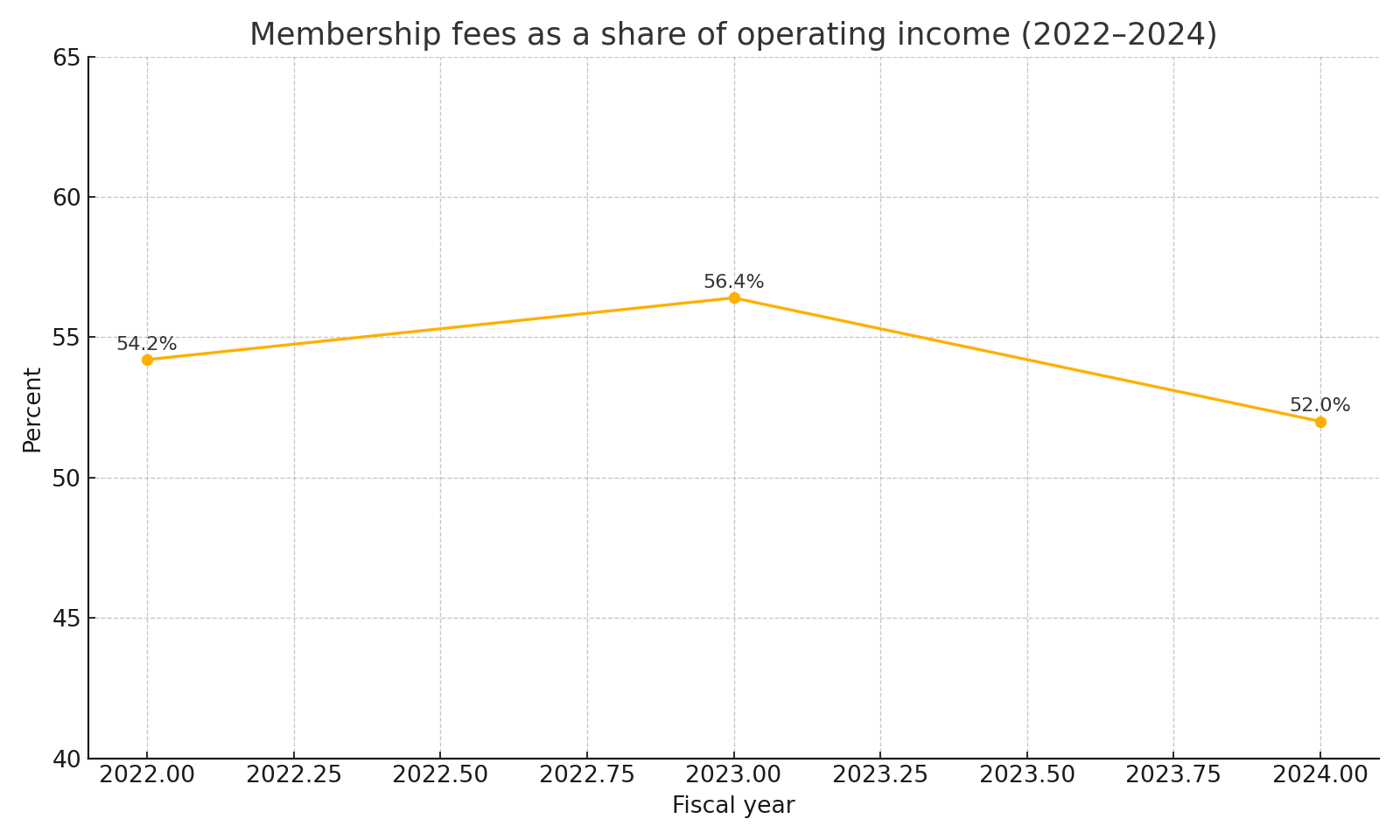

Membership fees cover a large share of operating income. In 2024, fees were about 52 percent of operating income. Over 2022 to 2024, fees compounded at roughly 6.9 percent per year.

Fees as a share of operating income

Fees as a share of operating income

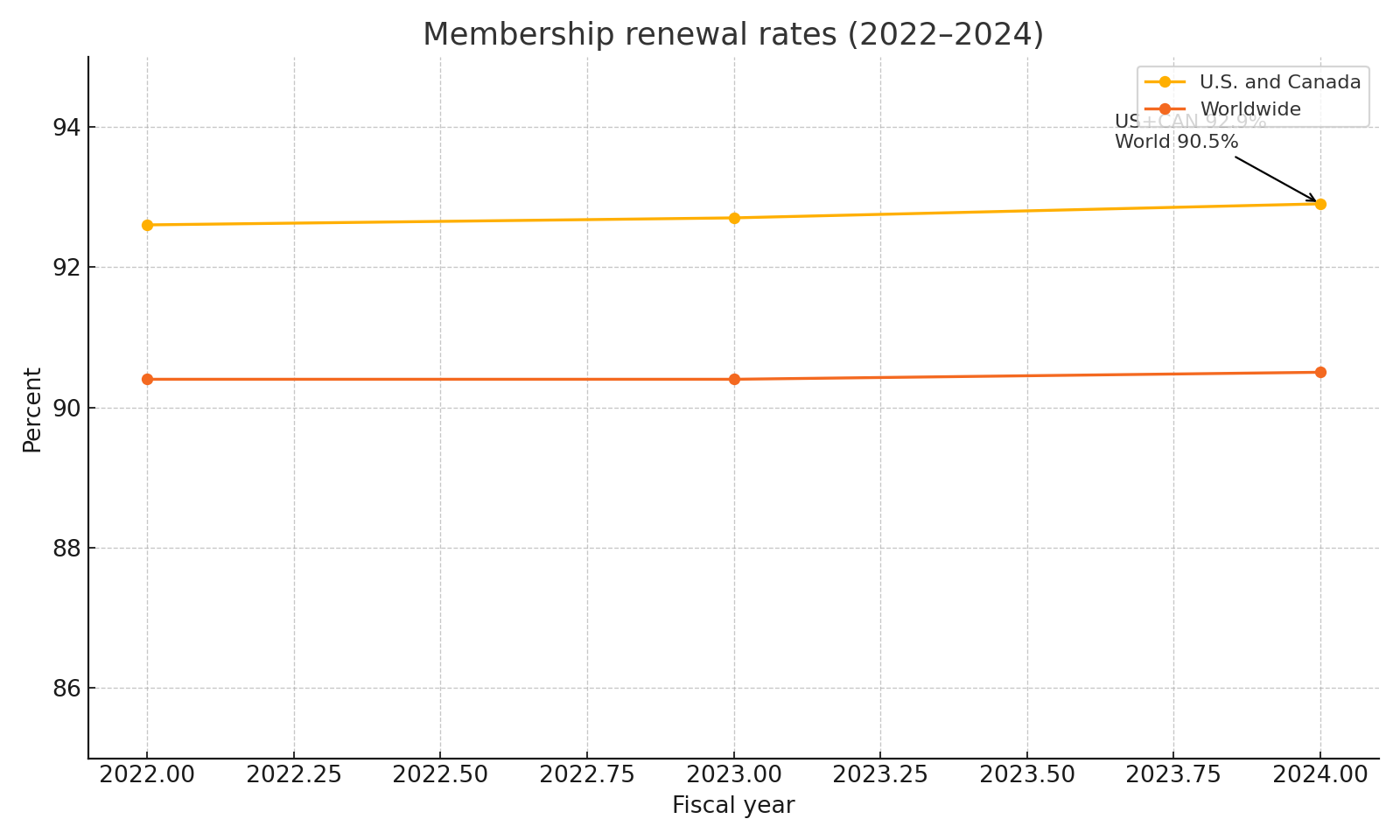

Renewal and loyalty

Renewal rates remained above ninety percent in both the United States and Canada and worldwide. That level of loyalty is rare in retail and gives Costco room to keep prices low while still delivering healthy profit.

Renewal rates 2022 to 2024

Renewal rates 2022 to 2024

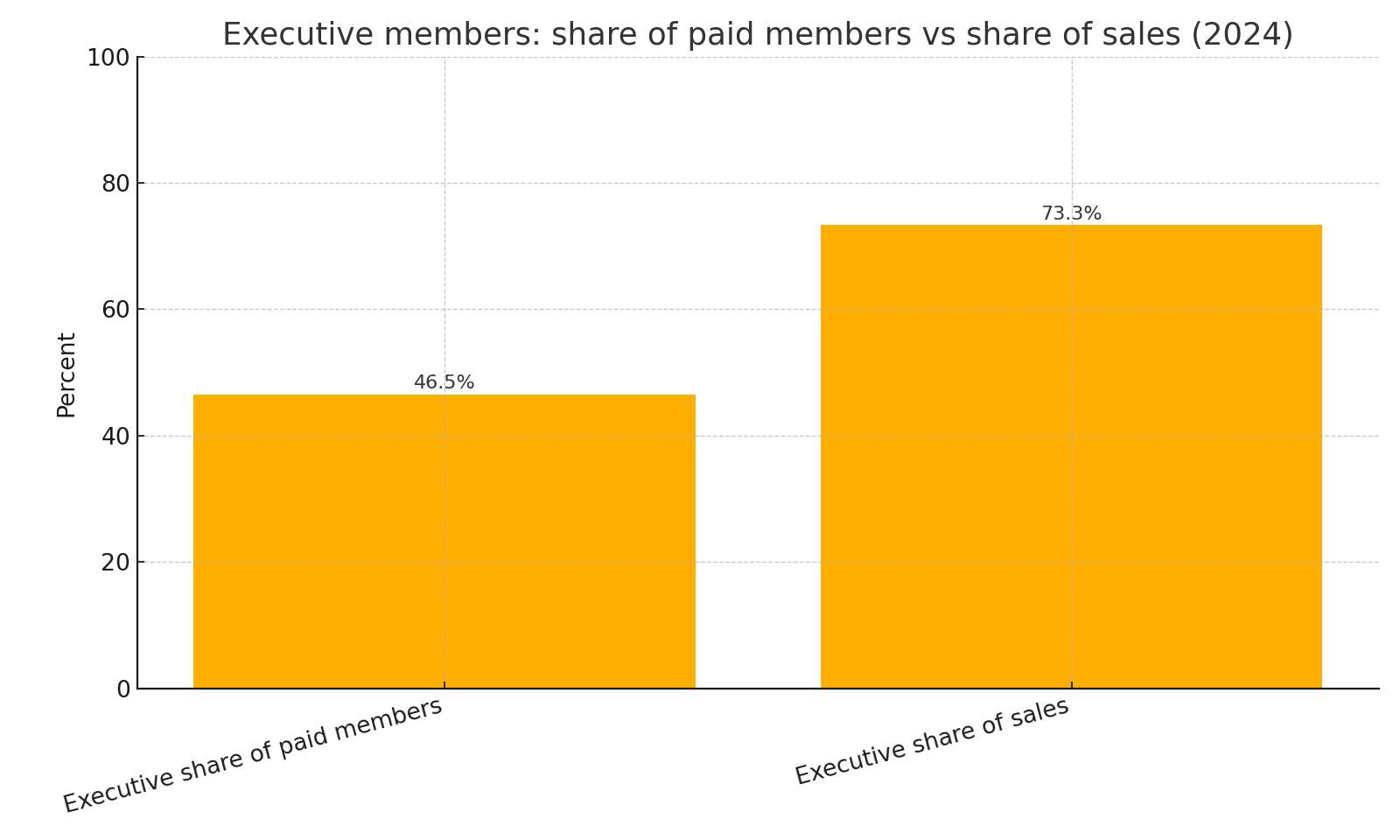

Executive members drive outsized sales

Executive households made up about 46.5 percent of paid members in 2024 but drove 73.3 percent of worldwide sales. That leverage explains the push to upgrade members to the Executive tier.

Executive share of paid members vs share of sales

Executive share of paid members vs share of sales

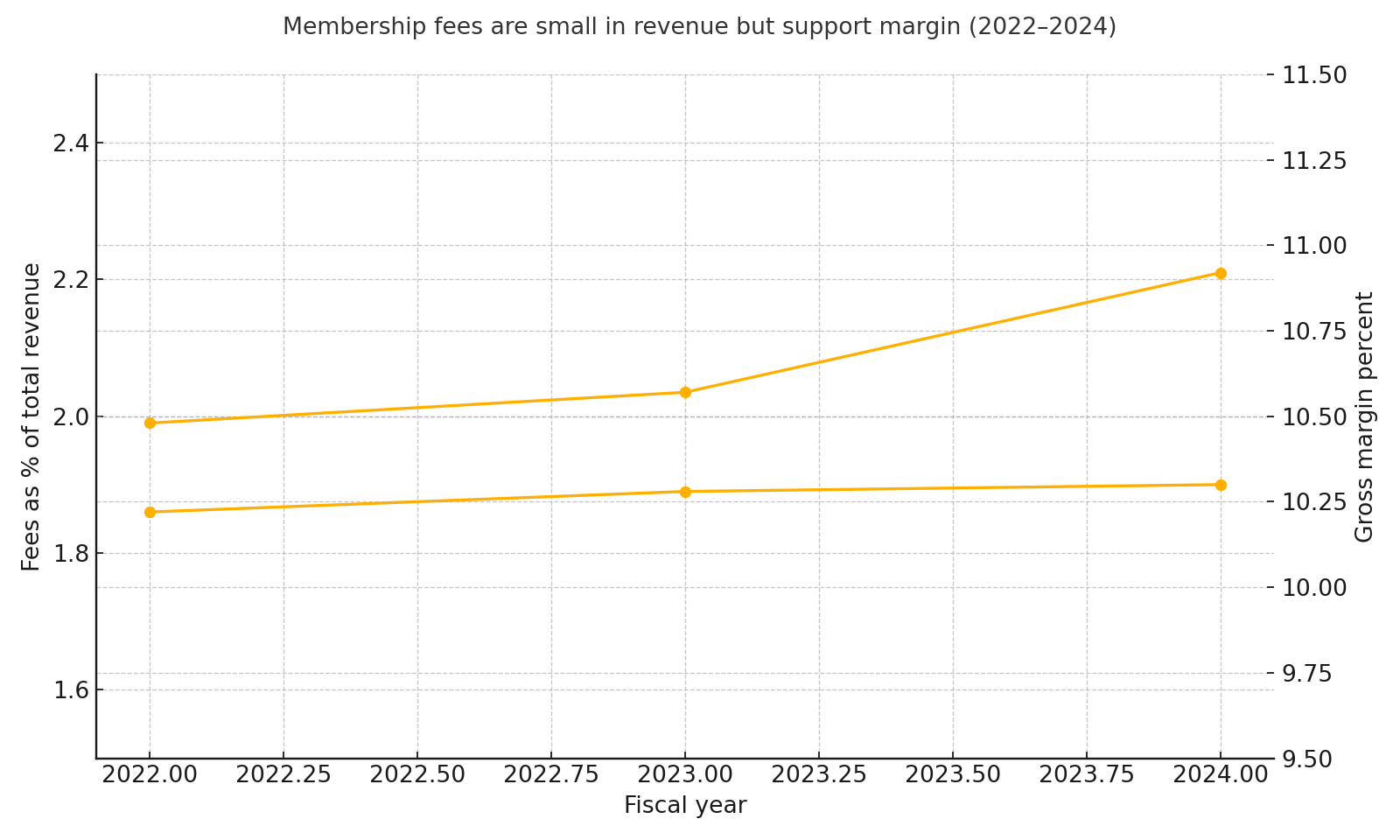

Small in revenue, big in impact

Membership fees are a small slice of total revenue, but they support Costco’s ability to keep margins steady and prices low.

Fees as percent of revenue vs gross margin

Fees as percent of revenue vs gross margin

Sources

- Costco 2024 Annual Report and Form 10 K: membership fees, renewal rates, gross margin, net sales, operating income, member counts, and Executive penetration.