Netflix economics: subscriptions, ads, and global reach

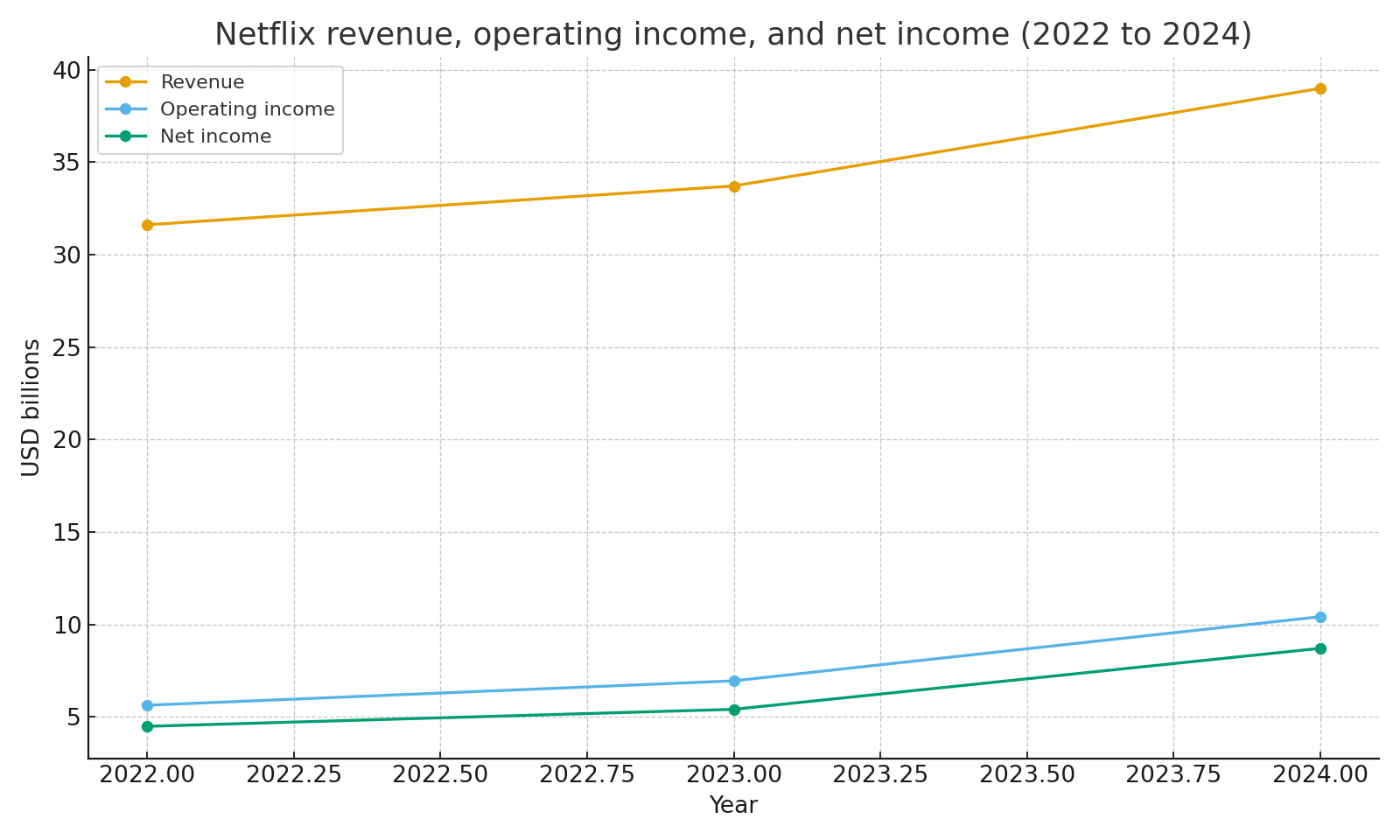

TL;DR: Netflix sells streaming subscriptions around the world and has started to build an advertising and live content business on top. From 2022 to 2024, revenue grew from $31.6B to $39.0B. Operating income rose from about $5.6B to about $10.4B. Net income climbed from about $4.5B to about $8.7B. Paid memberships increased from about 231 million to about 302 million.

Revenue and profit over time

Netflix moved from slower growth back to faster growth by focusing on paid sharing, pricing, and a broader slate of content. Revenue rose each year, and operating income and net income grew faster than sales as the company kept a tighter grip on costs.

Revenue, operating income, and net income

Revenue, operating income, and net income

Margin expansion

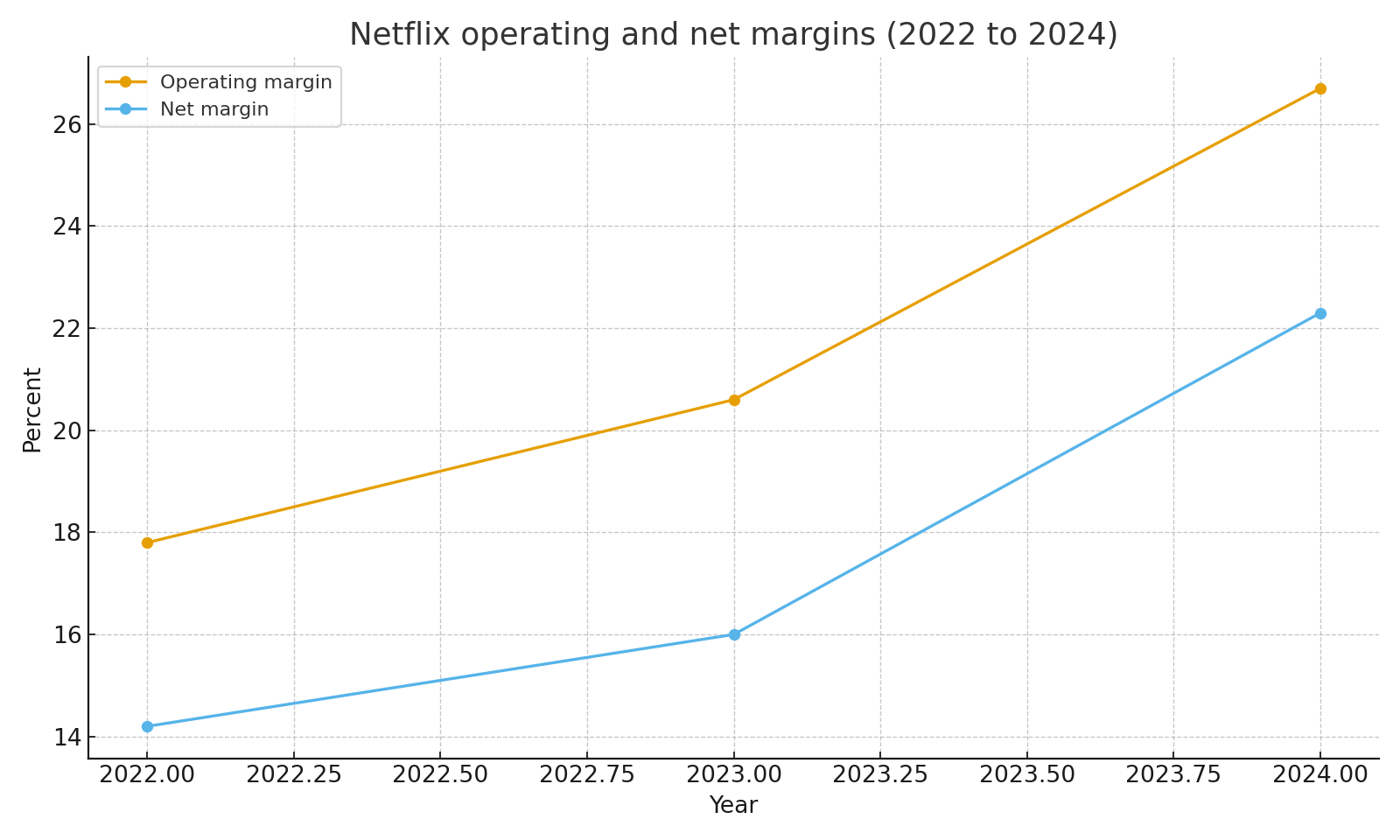

Operating margin improved as revenue grew faster than expenses. Net margin also moved up as the company kept interest and tax costs in check while the streaming business scaled. Higher margins mean that more of each dollar of revenue drops to the bottom line.

Operating and net margins

Operating and net margins

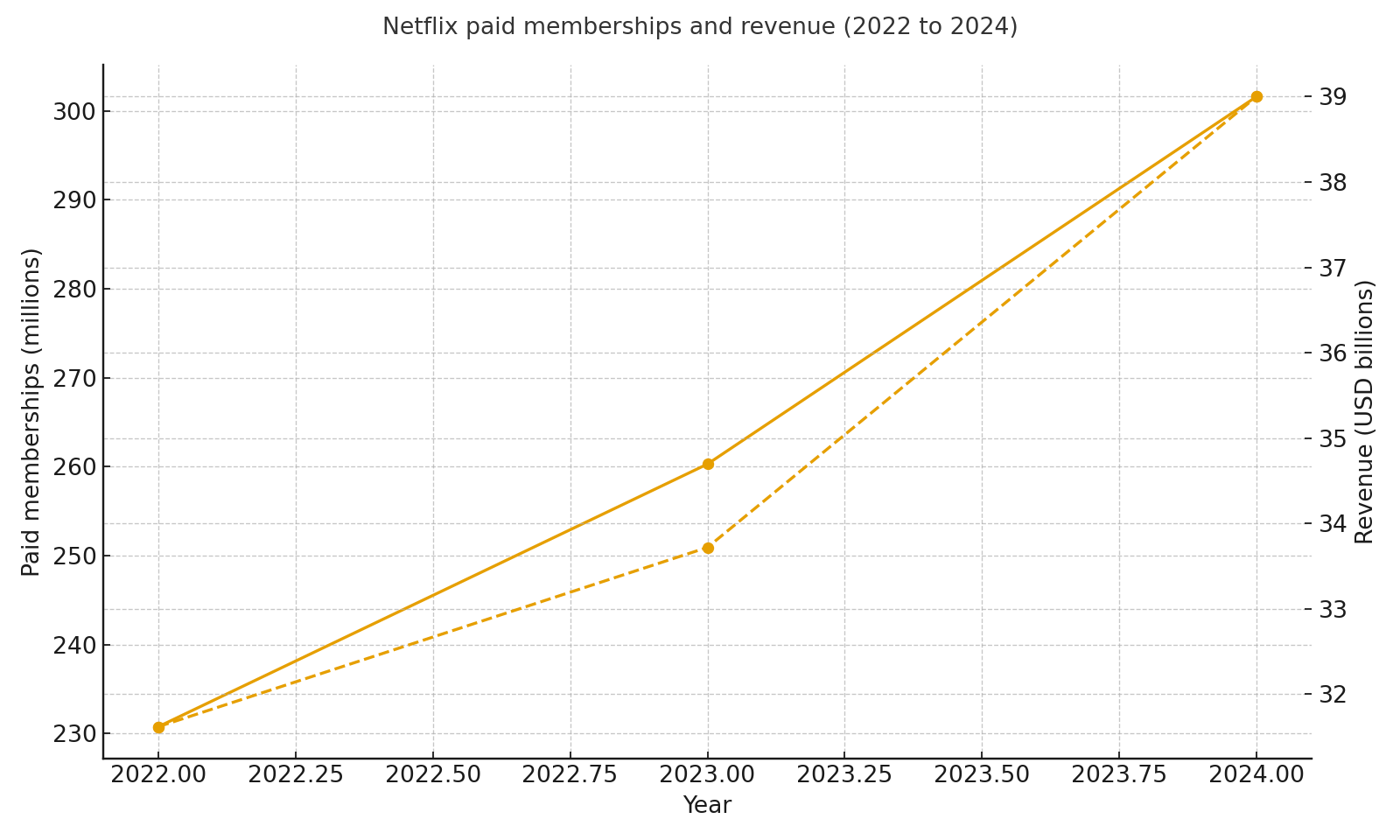

Memberships and monetization

The business still depends on memberships. Paid memberships ended 2022 at roughly 231 million, 2023 at about 260 million, and 2024 at just above 300 million. At the same time, revenue per member improved as Netflix adjusted prices and added higher priced plans in some markets. The chart below links paid memberships with total revenue.

Paid memberships and revenue

Paid memberships and revenue

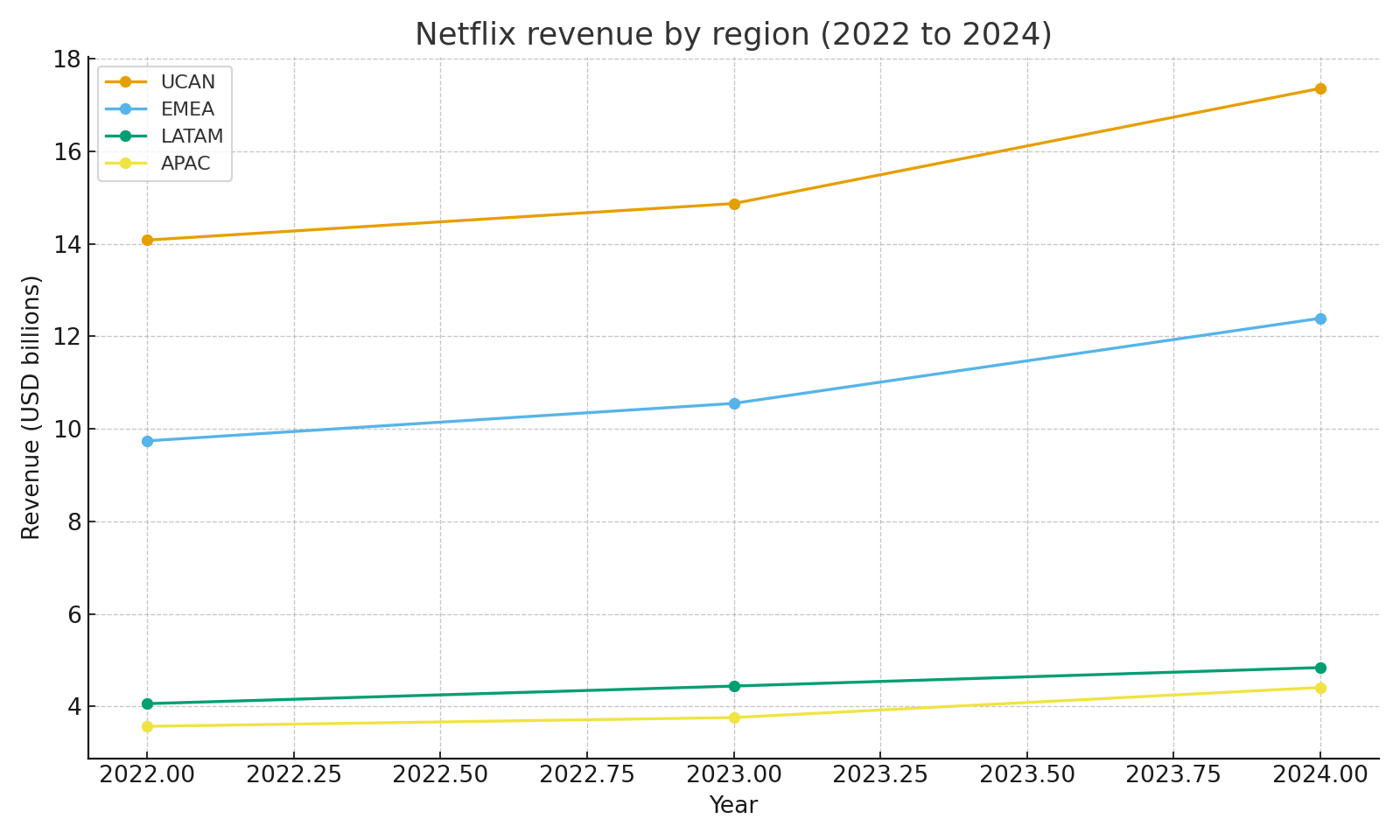

Geographic mix

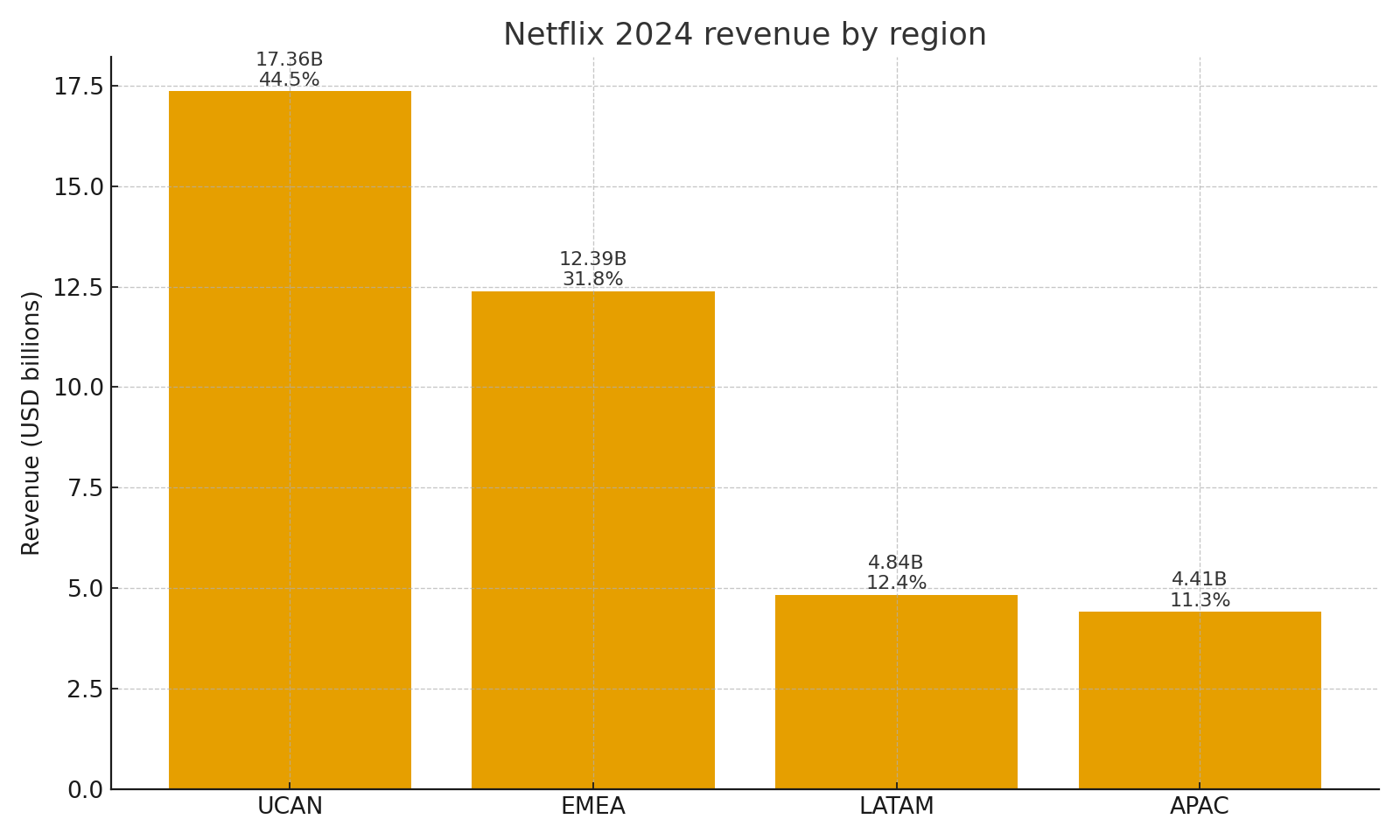

Netflix earns revenue from four main regions. In 2024, UCAN delivered about $17.4B, EMEA about $12.4B, LATAM about $4.8B, and APAC about $4.4B. All four regions grew from 2022 to 2024, with EMEA, LATAM, and APAC catching up over time as streaming adoption increased outside North America.

Revenue by region 2022 to 2024

Revenue by region 2022 to 2024

In 2024, UCAN accounted for a little under half of revenue, with the rest split across EMEA, LATAM, and APAC. This mix shows that Netflix has become a global business rather than a service tied mainly to one country.

Revenue mix by region in 2024

Revenue mix by region in 2024

Why this model works

Subscriptions give Netflix recurring revenue and some predictability. Content spending supports engagement, which reduces churn. Pricing power, paid sharing, and the growth of an advertising tier add more ways to monetize the base. Scale in technology and content helps spread fixed costs over a larger number of members and hours watched.

Risks to keep in mind

Competition for attention is intense, both from other streaming services and from social media and games. Content costs can rise faster than revenue if shows do not travel well across regions. Currency swings can move reported results for international markets. Regulation and tax changes in different countries can also affect growth and margins.

Sources

- Netflix 2022, 2023, and 2024 Annual Reports and Form 10 K for revenue, operating income, net income, and regional revenue

- Netflix shareholder letters and investor materials for paid membership counts and commentary on ads and paid sharing