NVIDIA economics: from graphics to data center AI

TL;DR: NVIDIA used to be known mainly for gaming graphics cards. Today most of its revenue and profit comes from data center platforms that power artificial intelligence. Total revenue grew from about $26.9B in fiscal 2022 to about $60.9B in fiscal 2024. Net income grew from about $9.8B in 2022 to about $29.8B in 2024. Data center revenue increased from about $10.6B to about $47.5B over the same period and made up a large share of total revenue.

Total revenue and profit

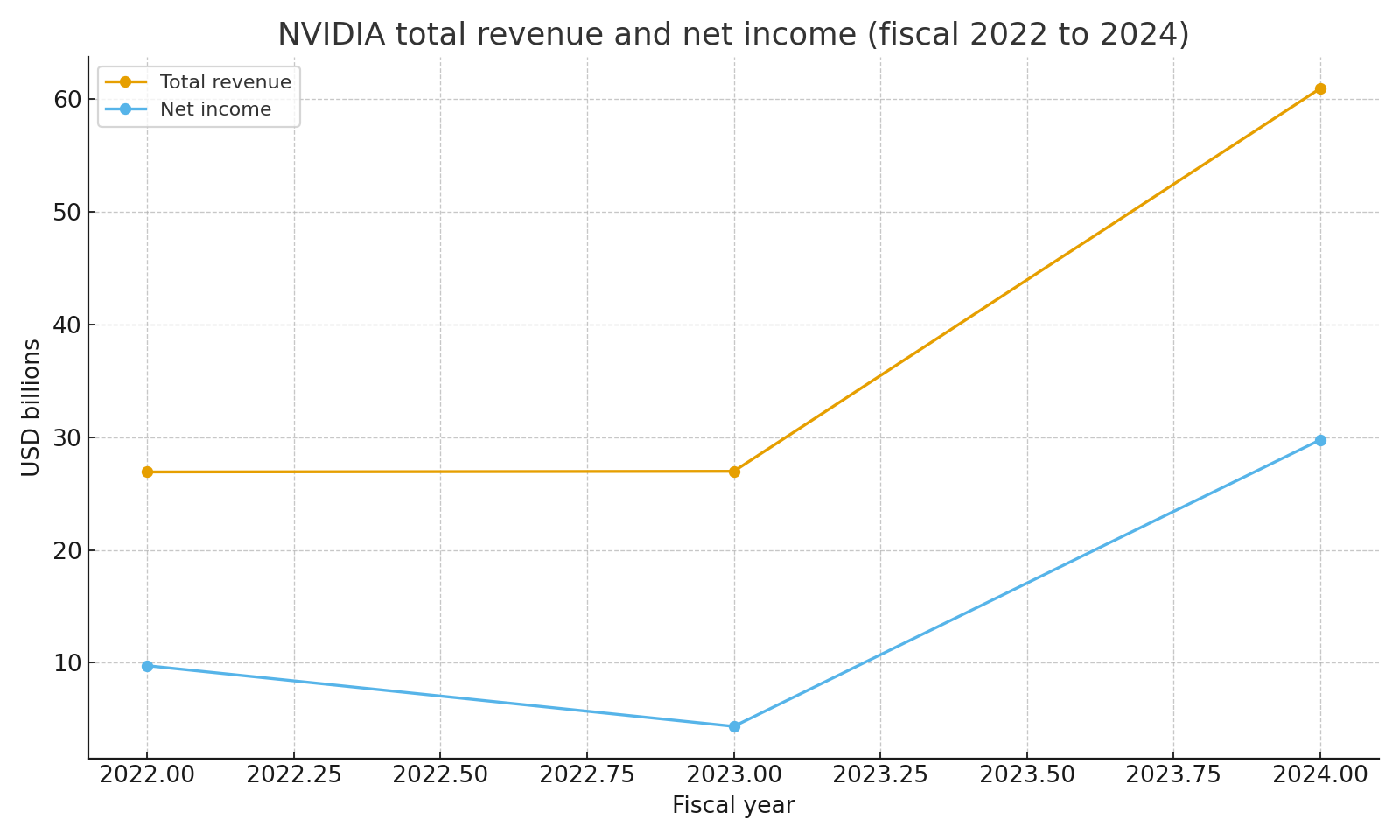

From fiscal 2022 to 2024, total revenue stayed roughly flat around $27B in 2022 and 2023, then more than doubled to about $60.9B in 2024. Net income followed that path, dropping in 2023 and then rising sharply in 2024 as data center demand for AI surged.

Total revenue and net income 2022 to 2024

Total revenue and net income 2022 to 2024

Revenue by market platform

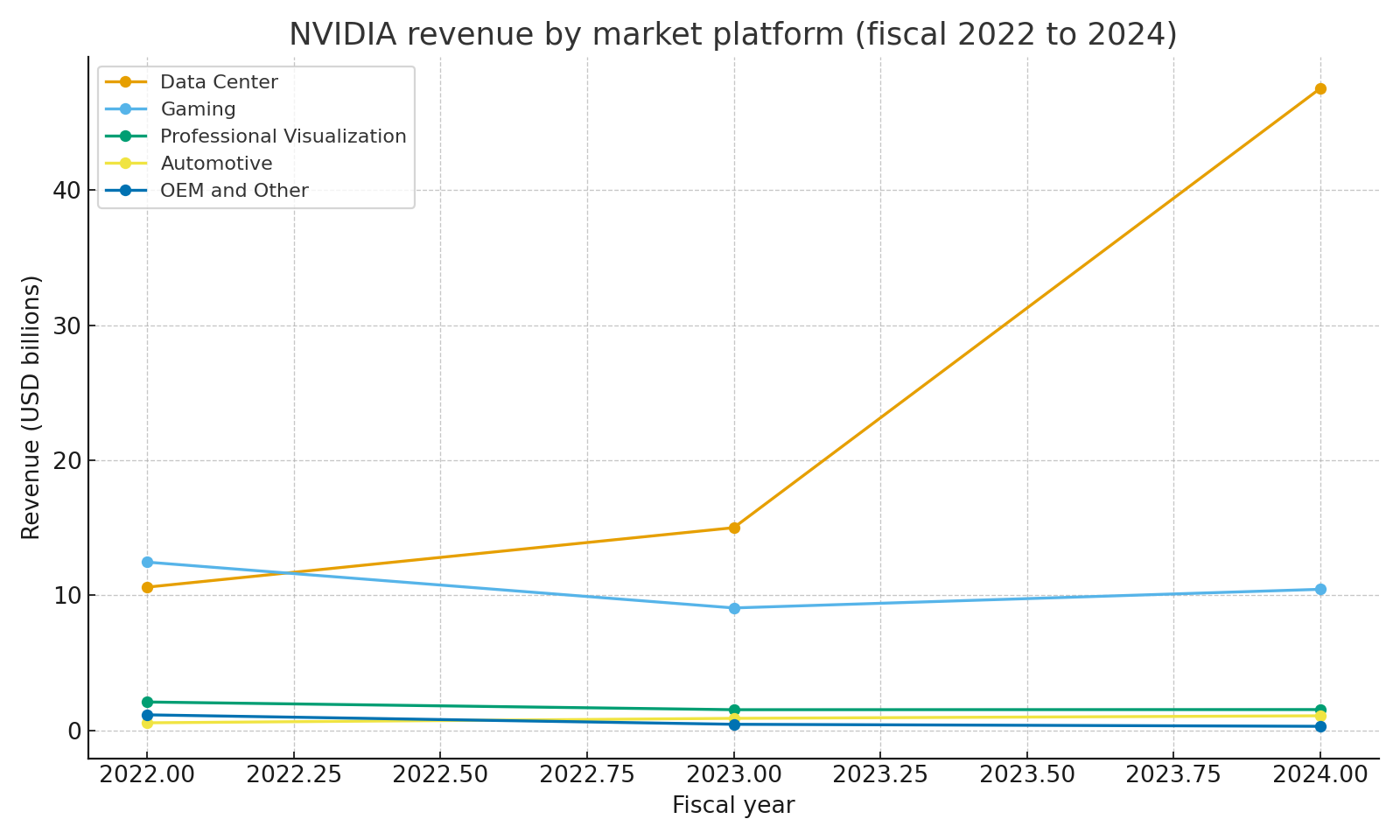

NVIDIA breaks out revenue into data center, gaming, professional visualization, automotive, and OEM and other. Data center has become the largest line. It grew from about $10.6B in 2022 to about $47.5B in 2024. Gaming was larger than data center in 2022 but is now much smaller in comparison. Professional visualization, automotive, and OEM and other are smaller lines that contribute on top.

Revenue by market platform 2022 to 2024

Revenue by market platform 2022 to 2024

Data center as the main driver

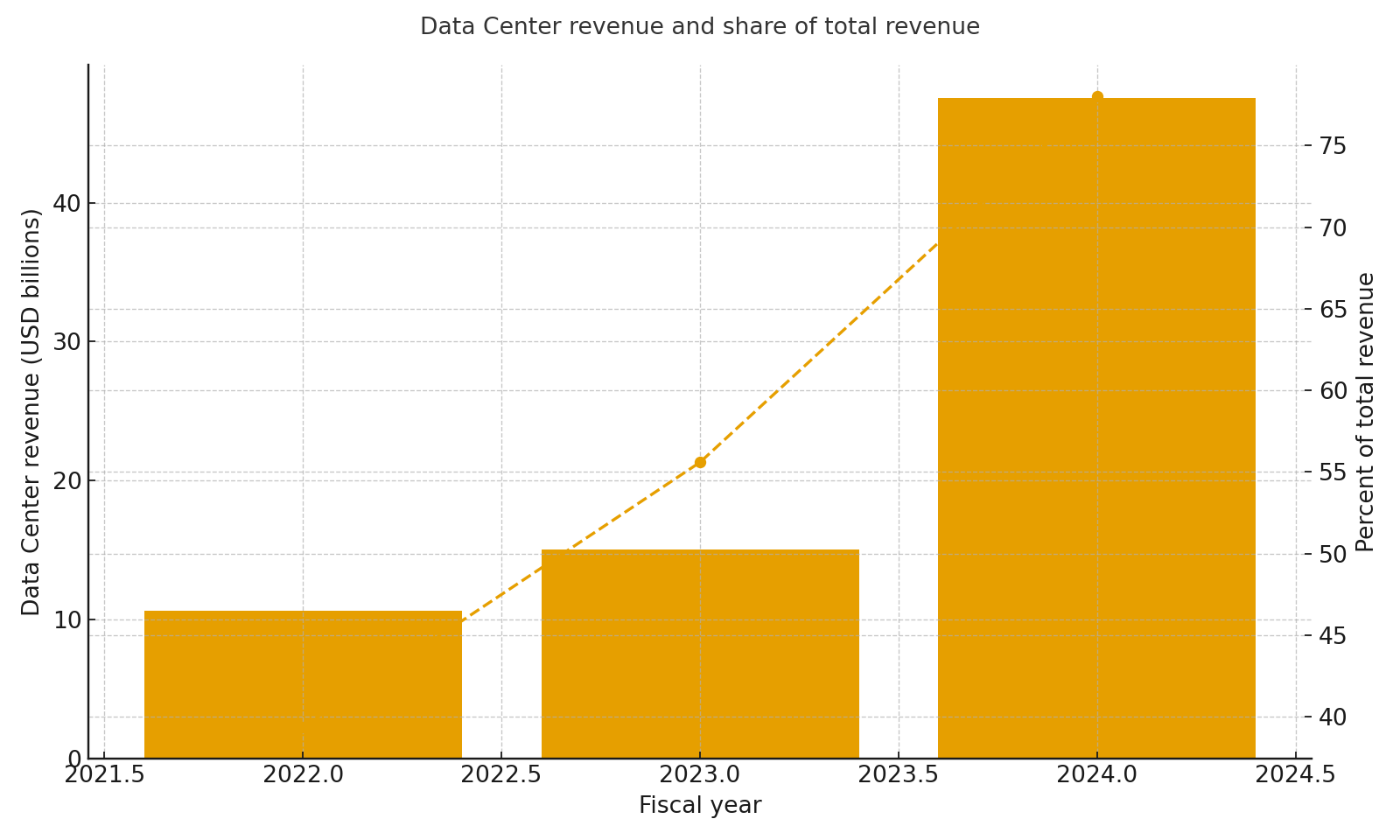

Data center revenue is now a large majority of the business. In 2024, data center was roughly 78.0 percent of total revenue. This reflects demand for GPUs, networking, and full systems used to train and run large language models and other AI workloads in cloud and enterprise data centers.

Data center revenue and share of total revenue

Data center revenue and share of total revenue

Geographic profile

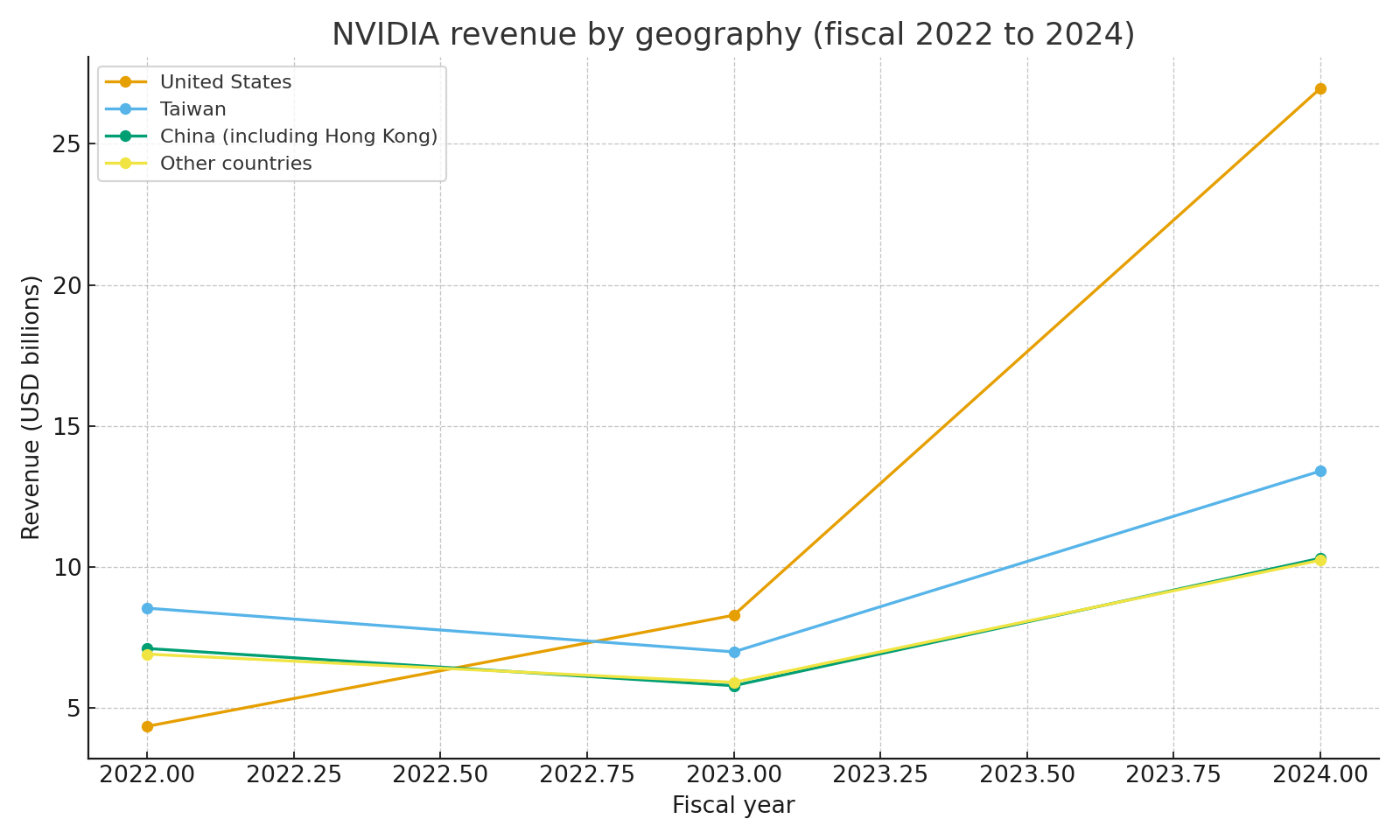

Revenue is spread across the United States, Taiwan, China including Hong Kong, and other countries. Revenue from the United States increased sharply in 2024 as cloud and large technology customers there bought more data center platforms. Taiwan and China remain important given the role of manufacturing partners and regional customers. Other countries also contribute a meaningful share.

Revenue by geography 2022 to 2024

Revenue by geography 2022 to 2024

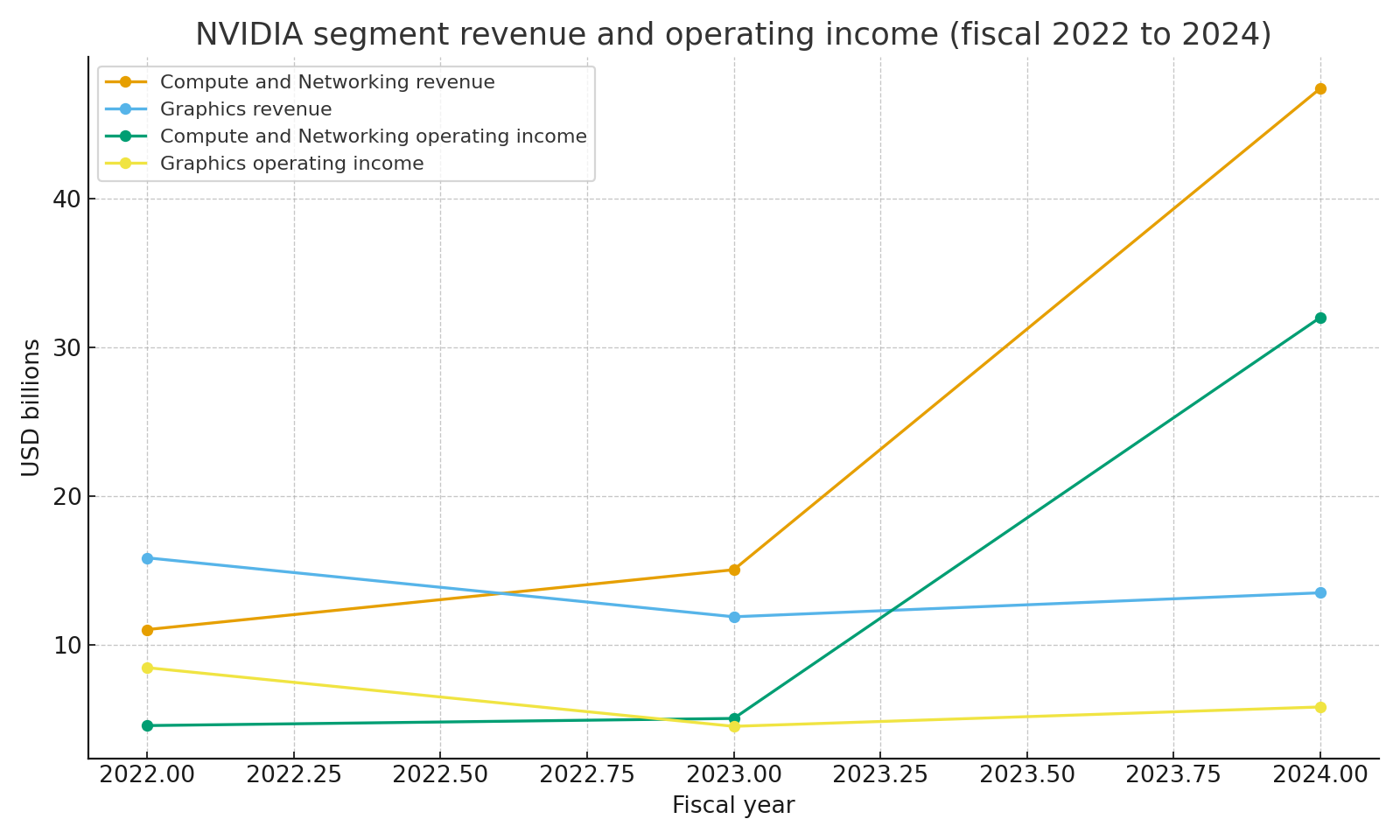

Segments and operating income

NVIDIA reports two main segments: Compute and Networking and Graphics. Compute and Networking includes data center and networking products. Graphics includes gaming and professional visualization products. From 2022 to 2024, revenue and operating income in Compute and Networking grew much faster than in Graphics. In 2024, Compute and Networking generated most of the operating income for the company.

Segment revenue and operating income 2022 to 2024

Segment revenue and operating income 2022 to 2024

Why this model works

NVIDIA designs hardware, software, and full platforms that can be used across several markets. Data center customers need high performance chips and networking to run AI and accelerated computing workloads. Gaming customers still want fast graphics for games and creative work. As long as NVIDIA keeps its platform attractive for developers and cloud providers, it can continue to sell high value systems with strong margins.

Risks to keep in mind

Demand for GPUs can be cyclical and depends on investment trends in AI and cloud computing. Export controls, especially related to China, can limit where the company can ship its highest performance products. Competition from other chip designers and from in house chips at large cloud providers is intense. Supply chain concentration in a few foundries and regions can also create risk.

Sources

- NVIDIA 2024 Form 10 K for revenue by market platform, segment revenue and operating income, geographic revenue, total revenue, and net income for fiscal 2022, 2023, and 2024

- NVIDIA 2023 Form 10 K and earlier filings for additional context on revenue by geography and historical trends