Ramp economics: corporate cards and saving companies money

Ramp is a private company that offers corporate cards and spend management software. Its pitch is simple. It will help companies control card spending and find ways to save money, while earning its own revenue from card use and software.

How Ramp works

Ramp gives companies corporate cards for their employees and a dashboard to track spending. Managers can set limits, define policies, and see where money is going in close to real time. The software also looks for waste, like duplicate subscriptions or unused licenses.

How Ramp makes money

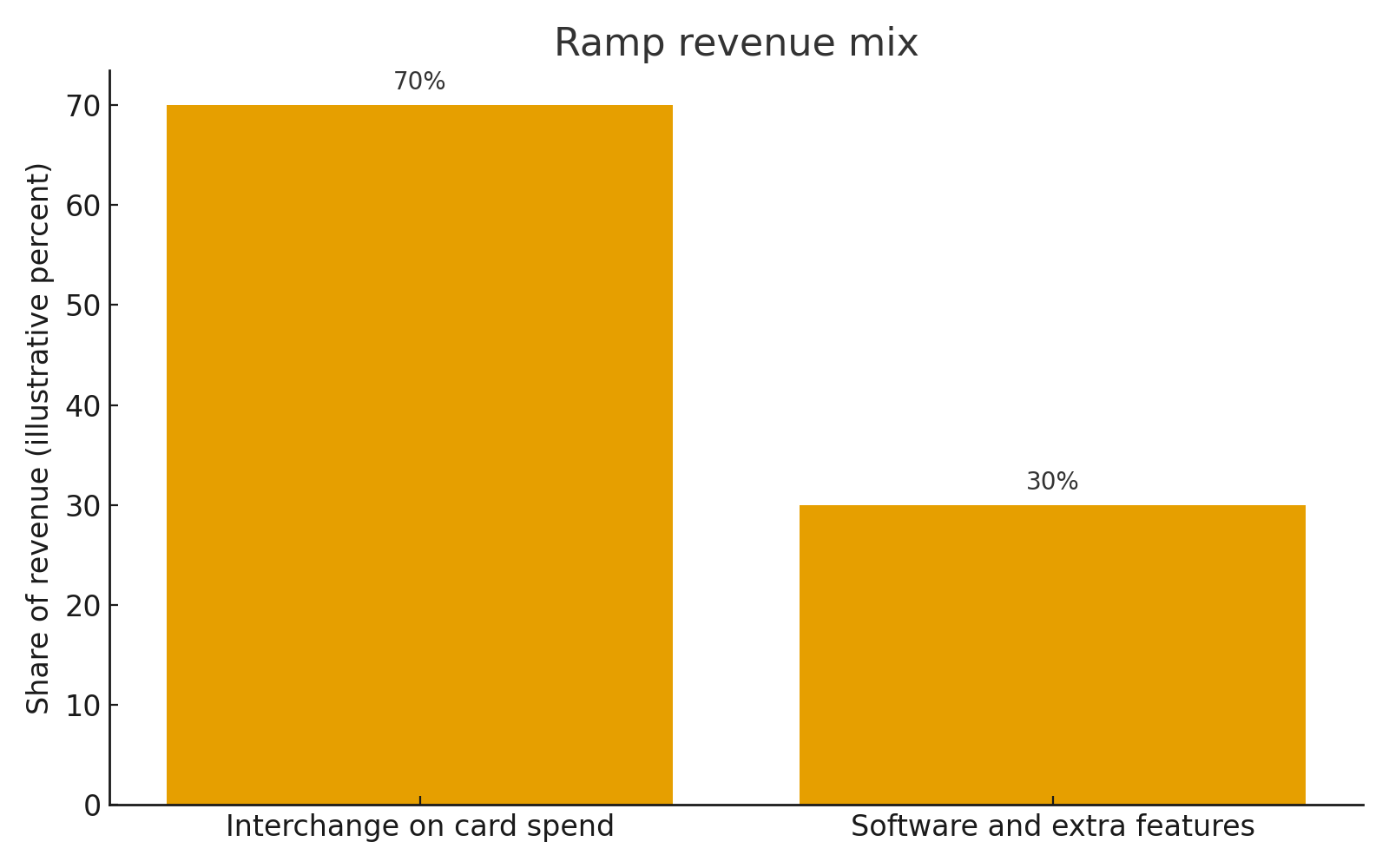

Most card companies earn interchange, which is a small fee taken from each transaction. Ramp does that too, but adds software and extra features on top. Some customers may pay for higher tiers of software or for deeper finance tools.

Ramp revenue mix

Ramp revenue mix

The mix can be thought of in two main parts. Interchange from card spend is the base. Software and extra features are the second layer that grows as customers rely more on the platform.

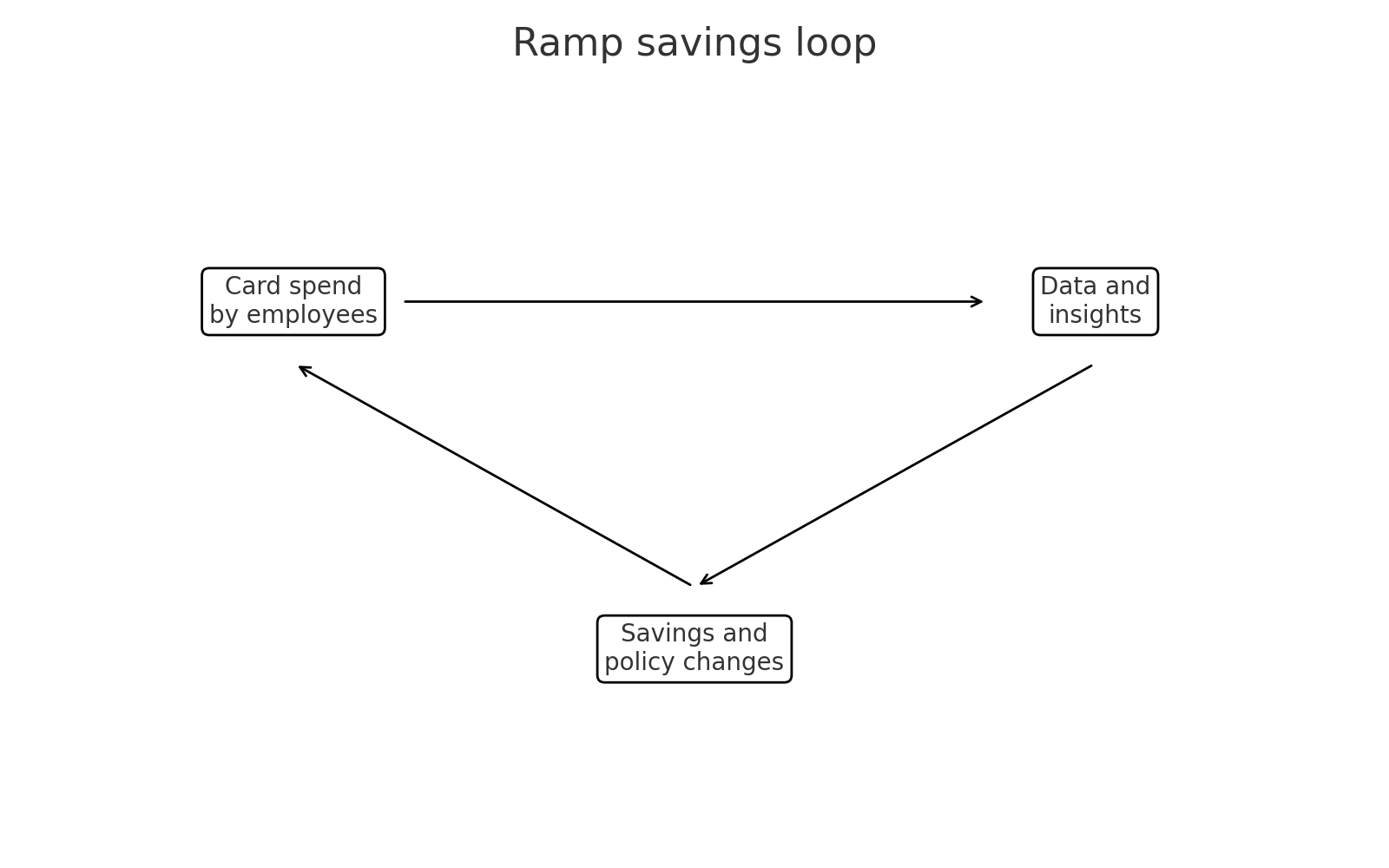

The savings loop

Ramp tries to stand out by focusing on savings instead of just rewards. It uses data on card spend to suggest where a company can cut costs, renegotiate contracts, or cancel wasteful spend.

Ramp savings loop

Ramp savings loop

Employees use cards for travel, software, vendors, and other spend. Ramp turns that spend into data and insights. Companies make changes based on those insights and save money. If Ramp helps a company save more than the cost of using the product, it becomes easier to justify keeping and expanding the relationship.

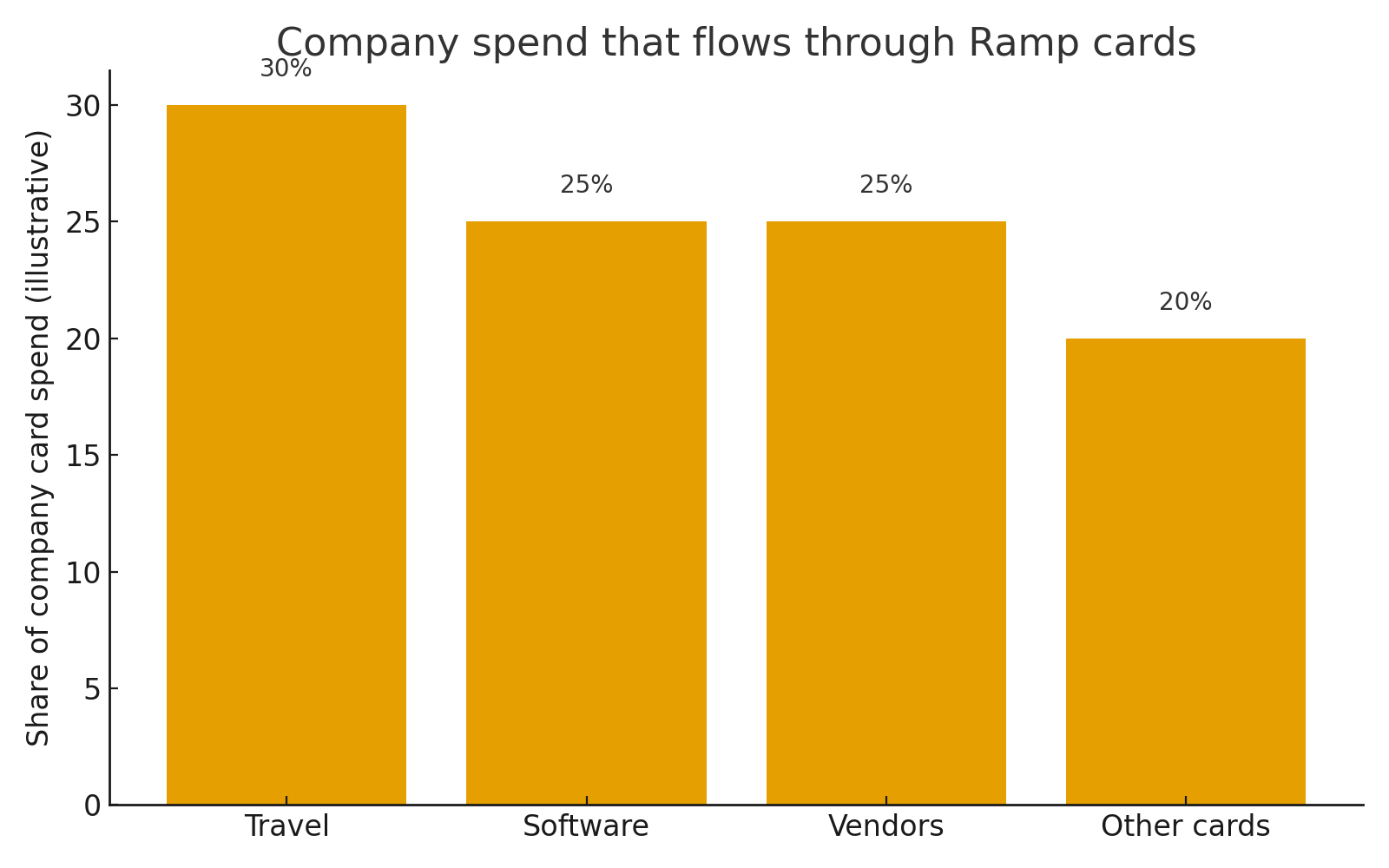

Ramp spend stack

Ramp spend stack

This chart shows the idea of spend flowing through Ramp cards. The more categories a company moves onto Ramp, the more data Ramp has and the more potential savings it can find.

Risks and challenges

Ramp competes with other corporate card providers, banks, and finance tools. Large customers can negotiate better terms or switch if they feel locked in. Ramp also has to balance making money from card spend with being seen as a partner that helps companies save money.

Still, Ramp is a clear example of a business model where helping customers reduce waste can support a solid stream of revenue from card use and software.

Sources

- Ramp’s public product pages and customer case studies

- Articles on corporate card economics and interchange based business models

- Industry write ups on spend management tools and finance automation

- Interviews and blog posts from Ramp’s team on their savings focused positioning