Shein economics: ultra fast fashion and a global app funnel

TL;DR: Shein is a private fast fashion company that does not publish full financial statements, but third party estimates show very rapid growth. Estimated revenue rose from about $0.6B in 2016 to about $38B in 2024. App downloads climbed into the hundreds of millions per year at the peak. The United States is the single largest market, and Shein is estimated to hold about 18 percent of the global fast fashion market, ahead of Inditex and H and M.

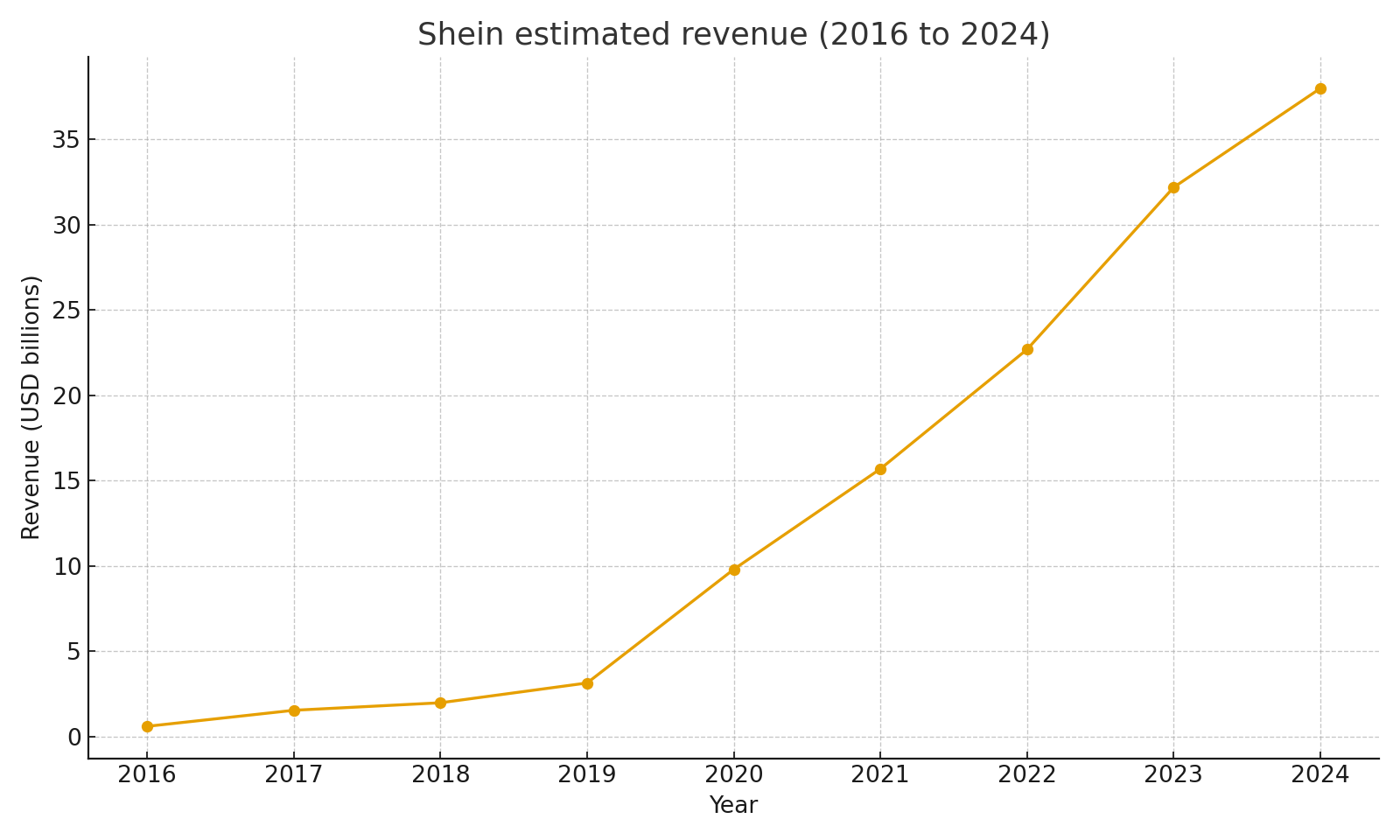

Estimated revenue growth over time

Analysts and data providers that track Shein suggest that revenue has grown almost every year since the middle of the last decade. On these estimates, Shein went from under $1B of revenue in 2016 to more than $15B in 2021 and roughly $38B in 2024. That kind of curve is closer to a technology company than a traditional retailer.

Estimated revenue 2016 to 2024

Estimated revenue 2016 to 2024

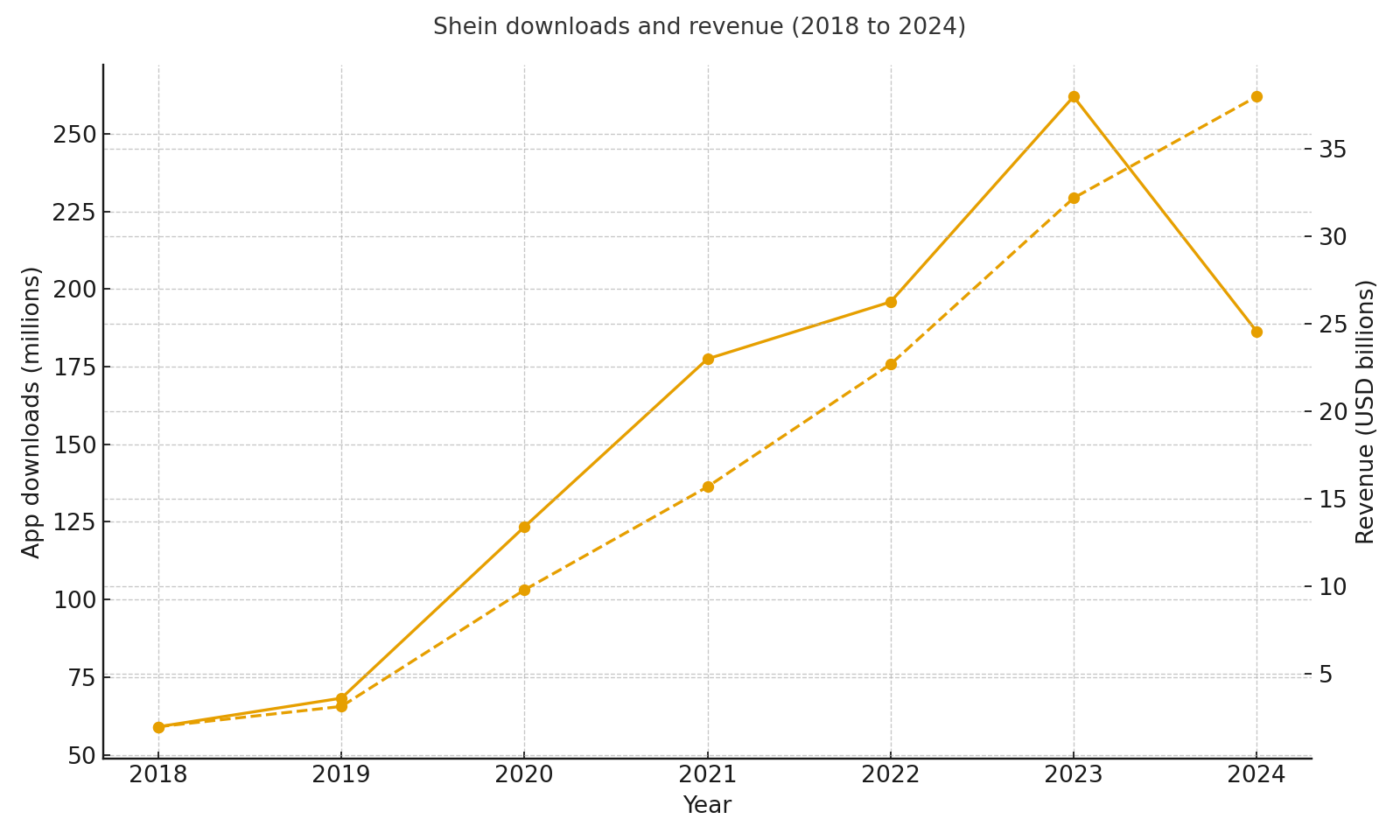

Downloads and revenue together

The growth in revenue went hand in hand with growth in app downloads. Annual downloads increased from tens of millions in 2018 to more than 260 million in 2023, before easing in 2024. Revenue moved up alongside, which suggests that Shein was able to convert new users into paying customers on a global basis.

Downloads and revenue 2018 to 2024

Downloads and revenue 2018 to 2024

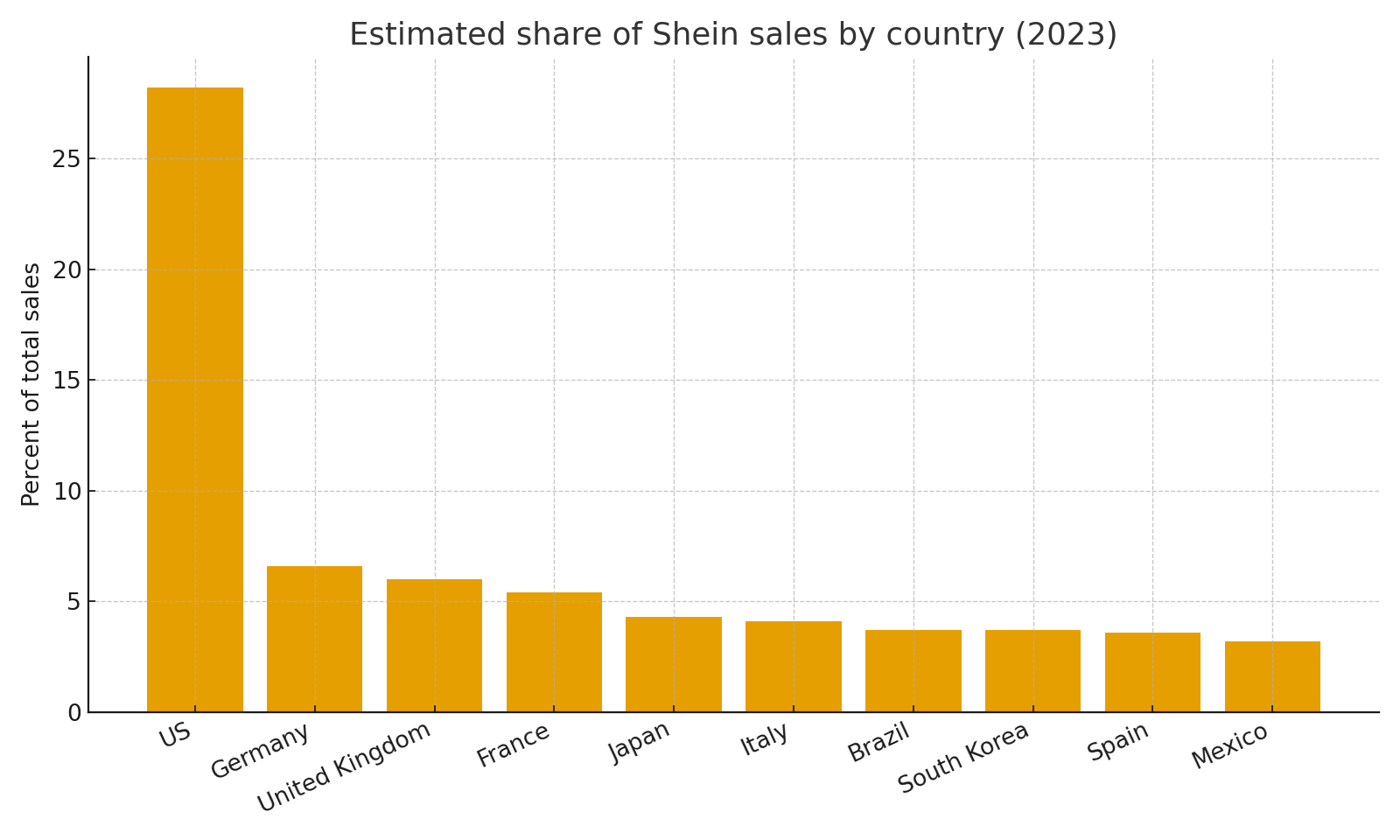

Where the sales come from

GlobalData estimates say that the United States accounted for about 28.2 percent of Shein sales in 2023. Germany and the United Kingdom were next, at 6.6 percent and 6.0 percent, followed by France, Japan, Italy, Brazil, South Korea, Spain, and Mexico. This spread shows that Shein is not just a single country story but a global brand with demand across the Americas, Europe, and Asia.

Sales share by country 2023

Sales share by country 2023

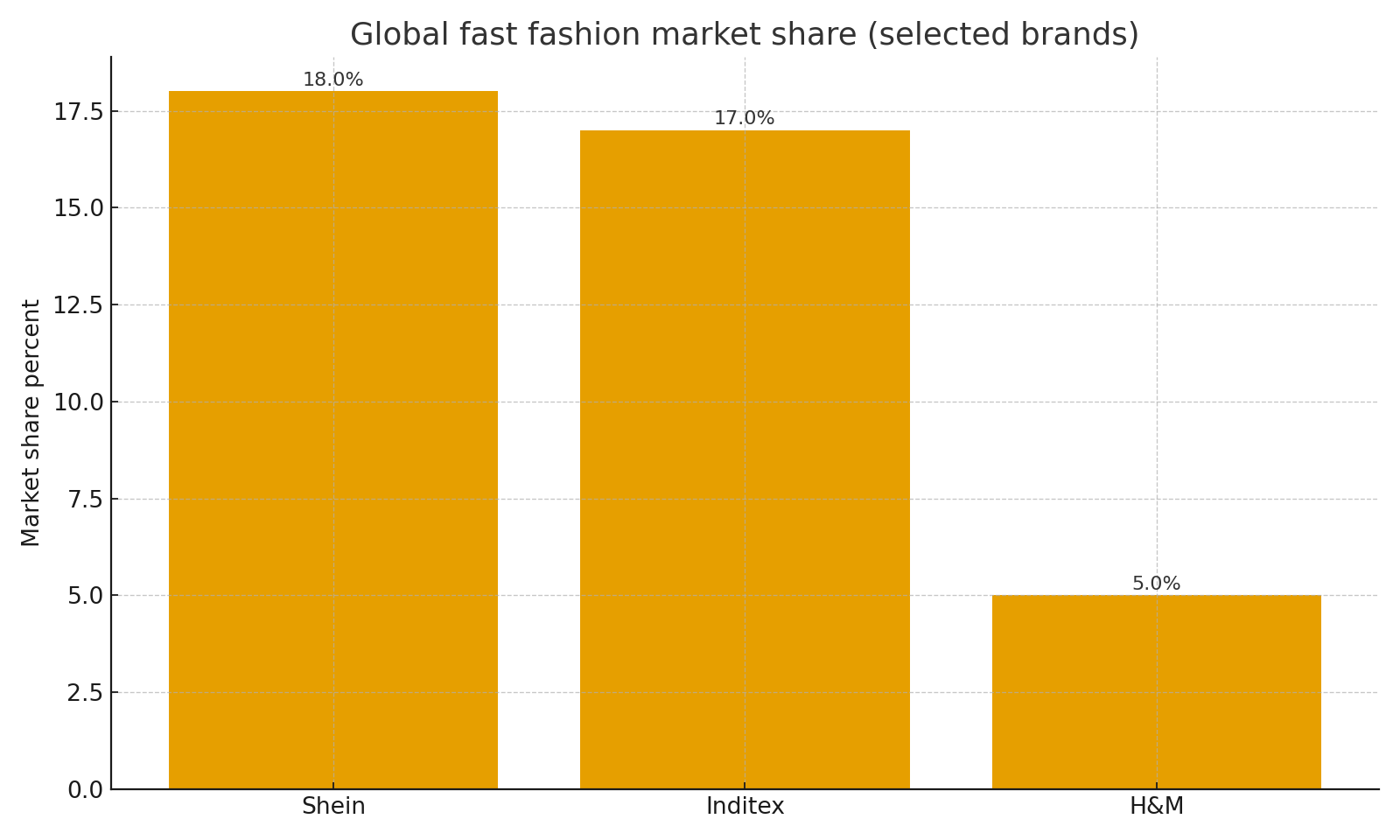

Position in fast fashion

Coresight Research data cited by Reuters indicates that Shein held about 18 percent of the worldwide fast fashion market, compared with about 17 percent for Inditex and about 5 percent for H and M. That makes Shein one of the largest players in its category by share, even though it is still privately held.

Fast fashion market share

Fast fashion market share

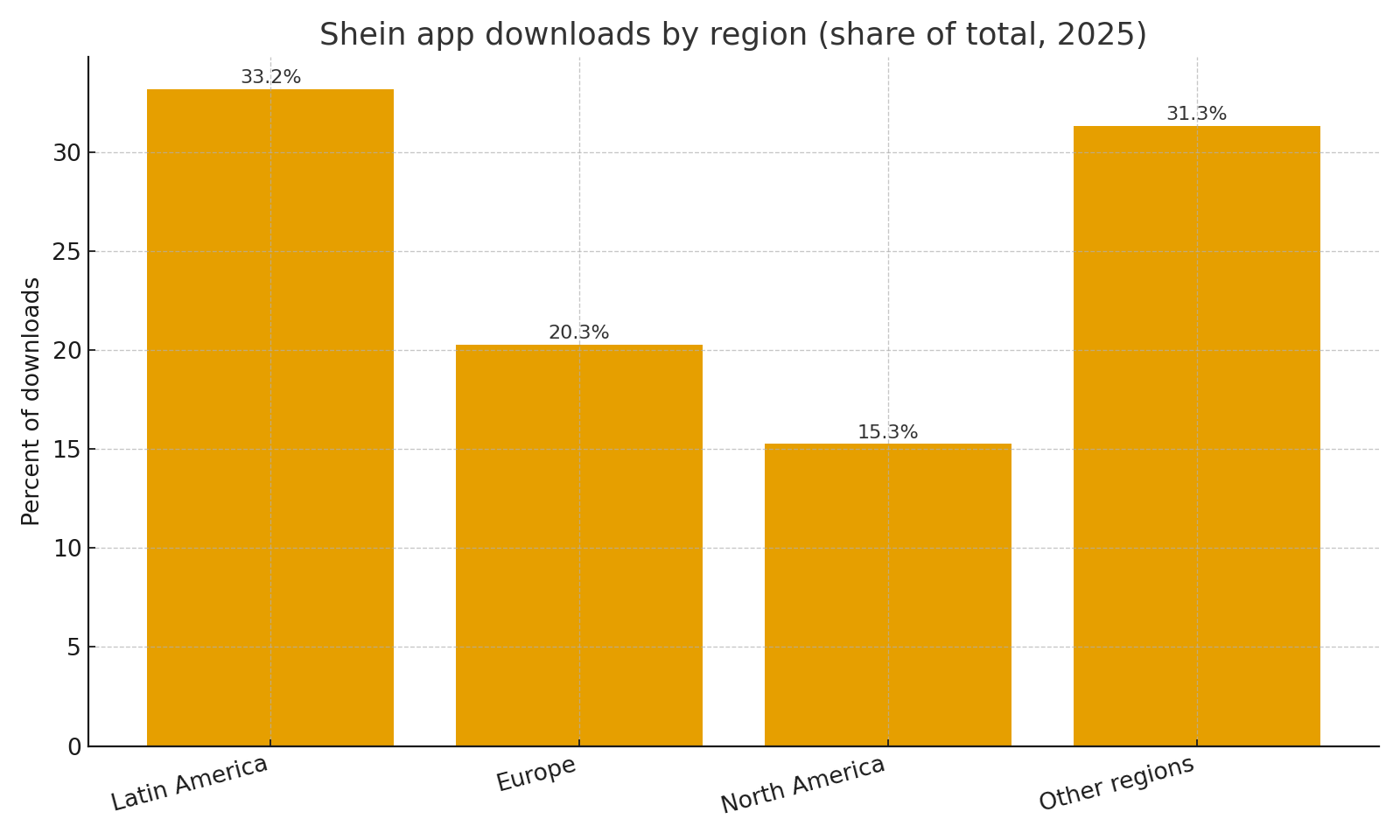

Downloads by region

Download data for mid 2025 suggest that Latin America accounted for about 33 percent of Shein app downloads, Europe for about 20 percent, and North America for about 15 percent, with the rest coming from other regions. This pattern lines up with the sales mix and shows how important emerging markets have become for Shein.

Downloads by region 2025

Downloads by region 2025

Why this model can work

Shein relies on a large network of suppliers, a test and repeat model for designs, and low price points. New items are produced in small batches, and only the designs that perform well are scaled up. The app lets Shein reach shoppers directly in many countries without a large store footprint. If the company can manage logistics, returns, and quality at scale while keeping prices attractive, the model supports rapid volume growth.

Risks and questions

Because Shein is private, the numbers here are based on estimates, not audited reports. The company faces questions about labor practices, sustainability, and the impact of ultra fast fashion on the environment. It also faces trade and regulatory risk as governments review import rules, digital taxes, and competition in online marketplaces. Competitive pressure from other low price platforms can also affect growth and margins.

Sources

- Backlinko summary of Shein revenue, downloads, market share, and regional statistics, based on data from Reuters, Statista, Business of Fashion, and GlobalData

- Reuters and other news coverage of Shein market share, valuation, and planned initial public offering in Hong Kong or London