Tesla economics: cars, storage, and margins

TL;DR: Tesla still earns most of its revenue from selling cars, but energy storage is growing fast and margins in that segment have improved a lot. From 2022 to 2024, total revenues moved from about $81.5B to about $97.7B. Net income peaked in 2023 at about $15.0B and then eased to about $7.1B in 2024. Automotive gross margin compressed while energy gross margin expanded.

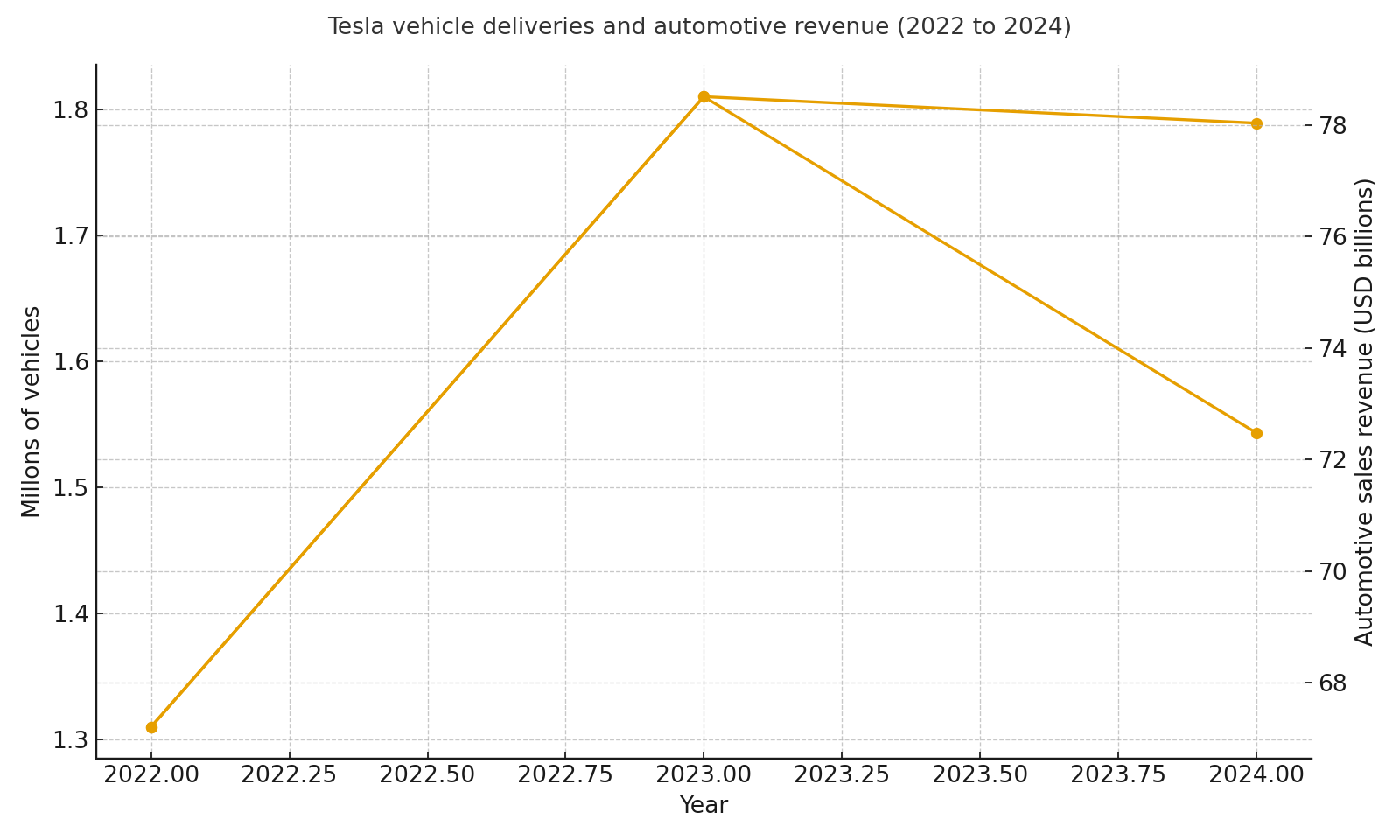

Deliveries and automotive revenue

Vehicle deliveries rose from about 1.31 million in 2022 to about 1.81 million in 2023, then slipped slightly to about 1.79 million in 2024. Automotive sales revenue followed a similar pattern, moving from about $67.2B to about $78.5B and then down to about $72.5B.

Deliveries and automotive sales revenue 2022 to 2024

Deliveries and automotive sales revenue 2022 to 2024

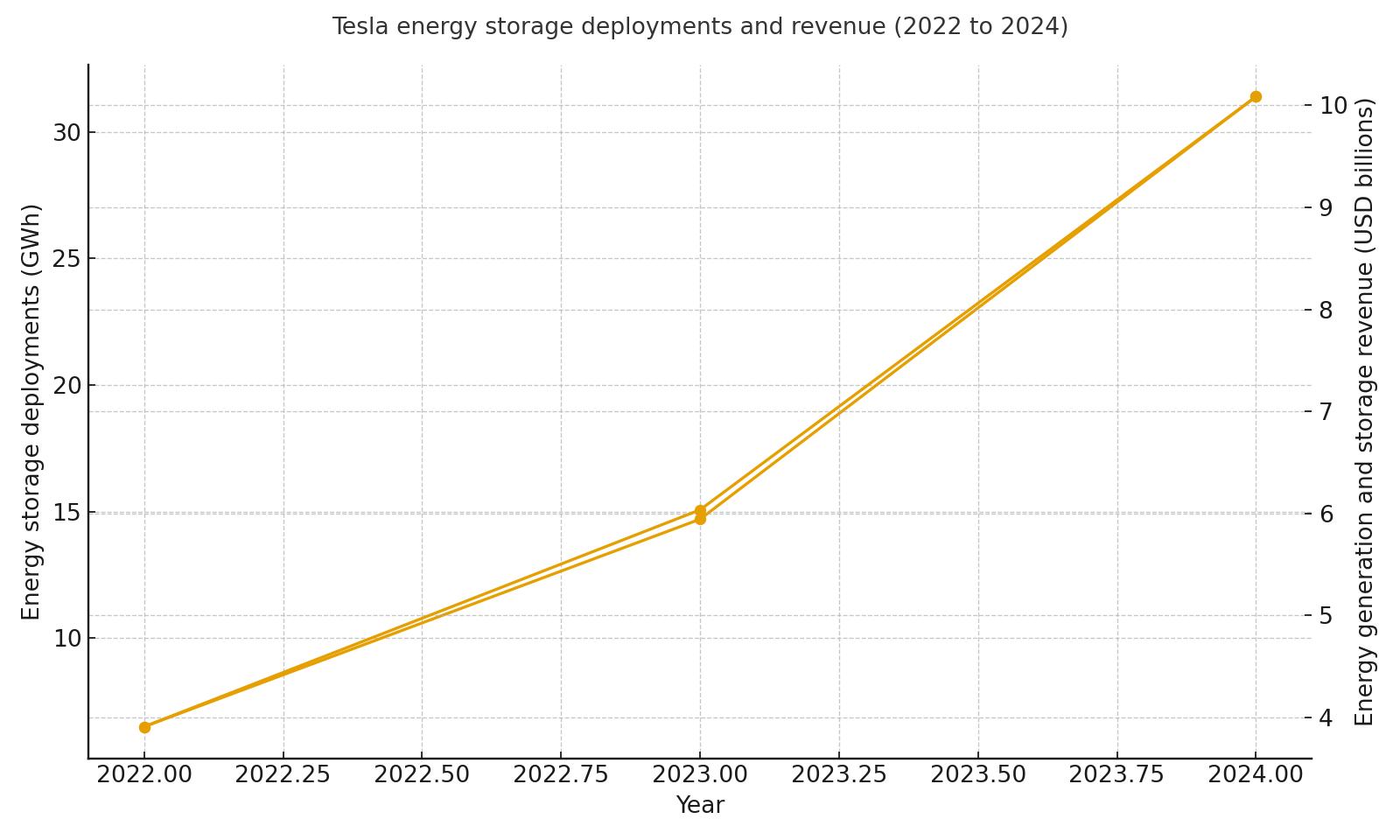

Energy storage scale

Energy storage deployments increased from about 6.5 GWh in 2022 to about 14.7 GWh in 2023 and then to about 31.4 GWh in 2024. Energy generation and storage revenue rose from about $3.9B to about $6.0B and then to about $10.1B over the same period.

Storage deployments and energy revenue

Storage deployments and energy revenue

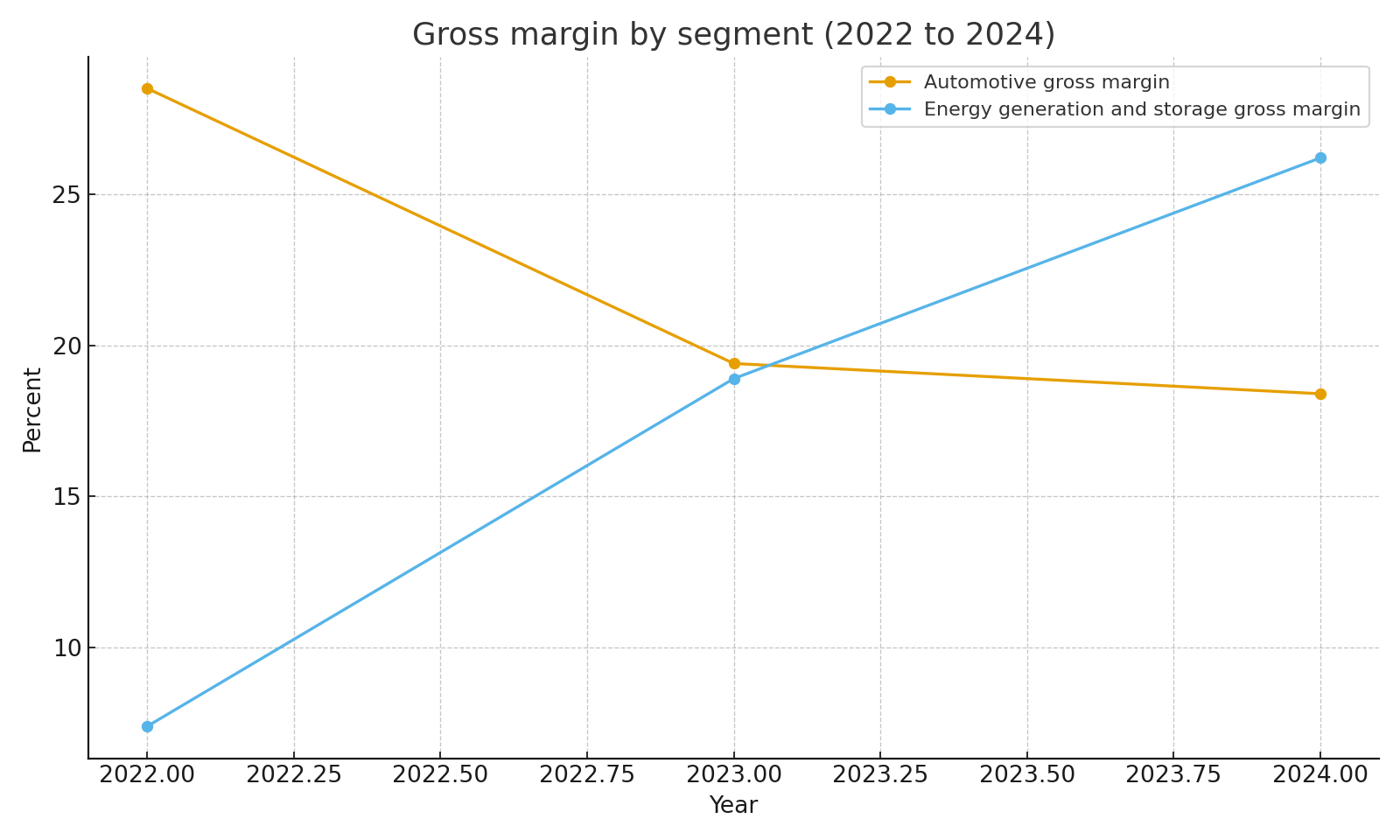

Segment margins

Automotive gross margin stepped down from around the high twenties in 2022 to the high teens in 2023 and 2024. By contrast, the energy generation and storage gross margin moved up from the single digits to the mid twenties as the storage business scaled and costs came down.

Automotive versus energy gross margin

Automotive versus energy gross margin

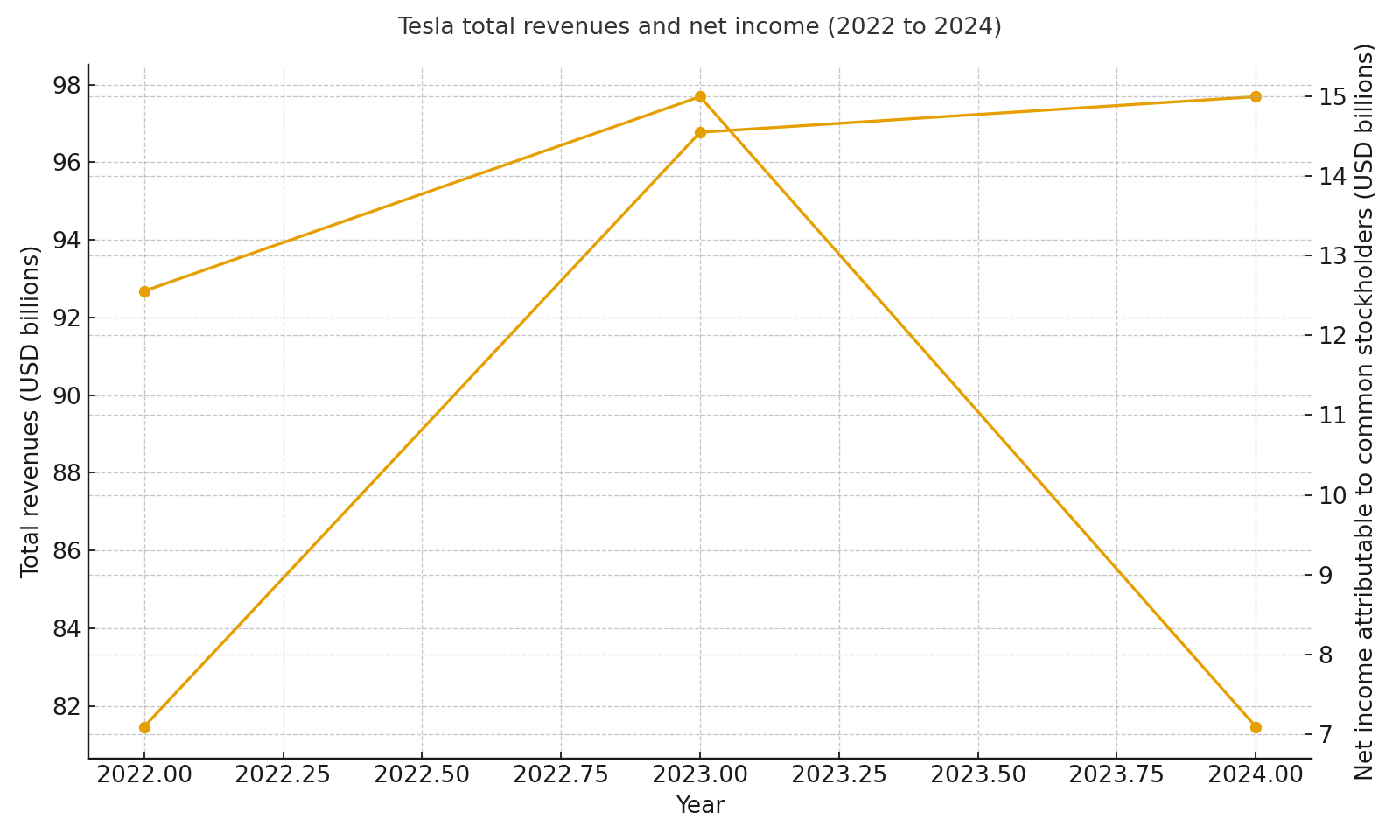

Revenue and profit together

Total revenues grew from about $81.5B in 2022 to about $96.8B in 2023 and $97.7B in 2024. Net income rose from about $12.6B in 2022 to about $15.0B in 2023 and then declined to about $7.1B in 2024, helped earlier by tax valuation changes and then pressured later by lower automotive margins.

Total revenues and net income

Total revenues and net income

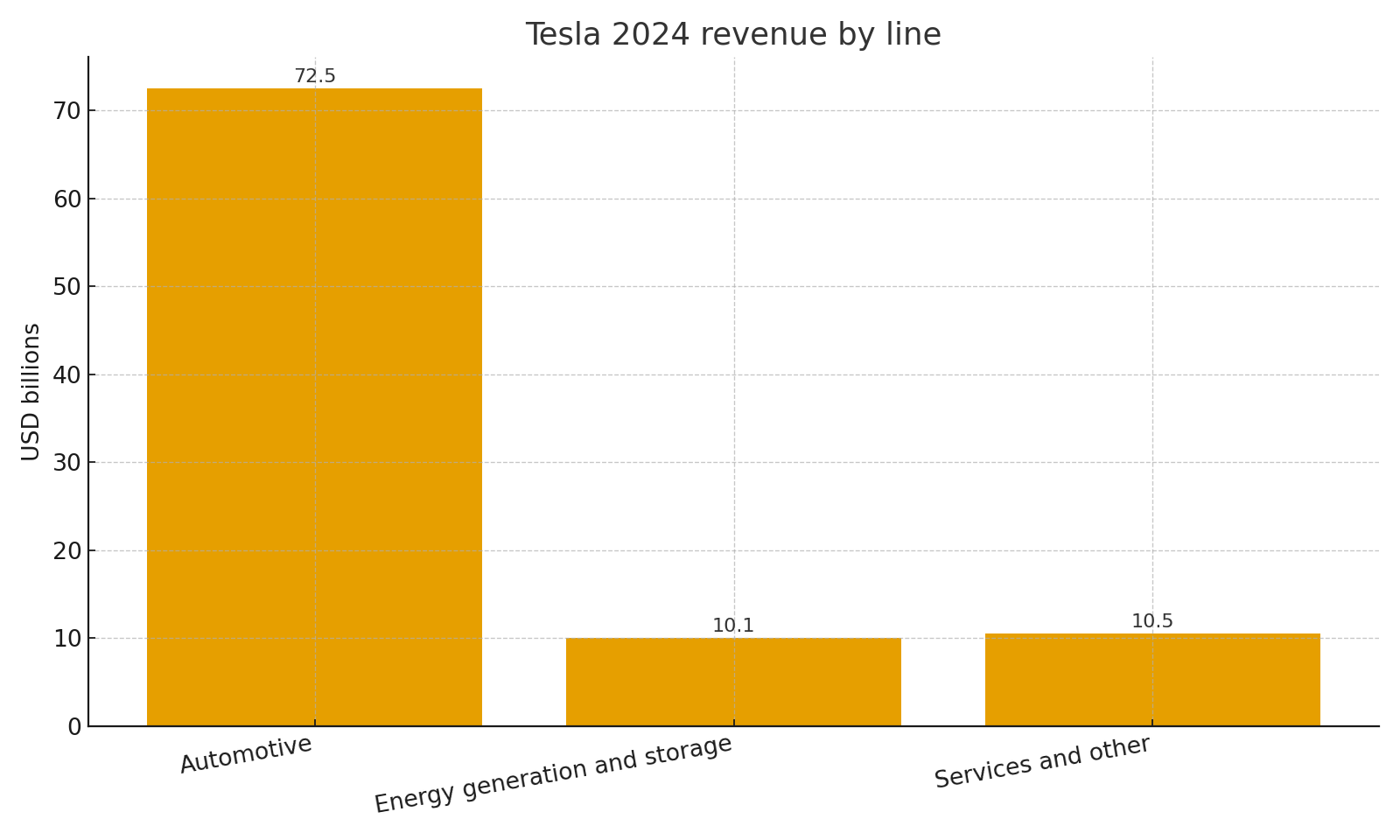

Where 2024 revenue came from

In 2024, automotive sales were about $72.5B, energy generation and storage revenue was about $10.1B, and services and other were about $10.5B. Cars still drive most of the top line, but energy is now large enough to matter on its own.

Tesla 2024 revenue mix

Tesla 2024 revenue mix

Why this model works

The automotive business gives Tesla scale in factories, supply chains, and software. Energy storage benefits from that scale and from rising demand for grid and behind the meter storage. As storage margins improve, the business adds a second profit engine next to cars. If Tesla can keep capital spending efficient while growing both sides, the model supports long term cash generation.

Risks to keep in mind

Competition in electric vehicles is intense and can pressure prices. Large storage projects depend on utility budgets, incentives, and project timing. Changes in energy policy, interest rates, and raw material costs can move both margins and demand. Market expectations also swing with news about autonomy, new models, and factory expansion.

Sources

- Tesla 2024 Form 10 K for total revenues, net income, segment revenue, gross margins, and regional breakdowns

- Tesla updates and press releases on deliveries and energy storage deployments